Are you a fan of QuickBooks Self-Employed? Maybe you own and operate a small business, or you’re a solopreneur and you’ve heard that QuickBooks Self-Employed is the best way to file your taxes. Maybe you’re a Lyft or Uber driver and you heard that they have partnered with QuickBooks Self-Employed to help you file your taxes and get reimbursed for your mileage. Alternatively, you might be a freelancer, Real Estate agent, or eCommerce site owner that needs to file a schedule C.

Whichever position you’re in, you’ve clicked on this article because you want to learn more about how to use this software successfully.

So here we’ll dive into what makes QuickBooks Self-Employed a great choice for filing your taxes and/or mileage tracking.

We’ll also cover the best ways to use the software as well as what supplemental business tools you may be missing in your solopreneur toolbelt.

As a small business owner, it’s impossible not to know about Intuit (the creators of QuickBooks and TurboTax) in the blog-o-sphere. They’ve been around since 1983 and are the market leader as far as tax filing.

Created in 2014, QuickBooks Self-Employed is actually one of the newer additions to the Intuit family.

Compare this to QuickBooks Online, which is more suited towards larger companies.

QuickBooks Self-Employed is the perfect choice if you’re a solopreneur or small business owner that’s working for yourself and building your own empire – one brick at a time.

We salute you as charting your own course in life can be a challenging journey. So let’s see how QuickBooks Self-Employed can be an ally on your journey.

IS QUICKBOOKS SELF-EMPLOYED RIGHT FOR YOU?

Here are some general guidelines you can use when deciding if QuickBooks Self-Employed is right for you:

- Do you primarily pay for expenses in your business with cash or cards?

- Do you need to file a Schedule C with Form 1040?

- Do you not have any employees or contractors? (QuickBooks Self-Employed Self-Employed doesn’t have a payroll function)

- Do you accept credit cards as payment? (Not more than 10 invoices per month)

- Do you generally not write many checks?

If you answered ‘Yes’ to most of these, you’re a prime candidate for using QuickBooks Self-Employed.

If you have employees or contractors, you may want to check out the features of QuickBooks Online.

TOP FEATURES

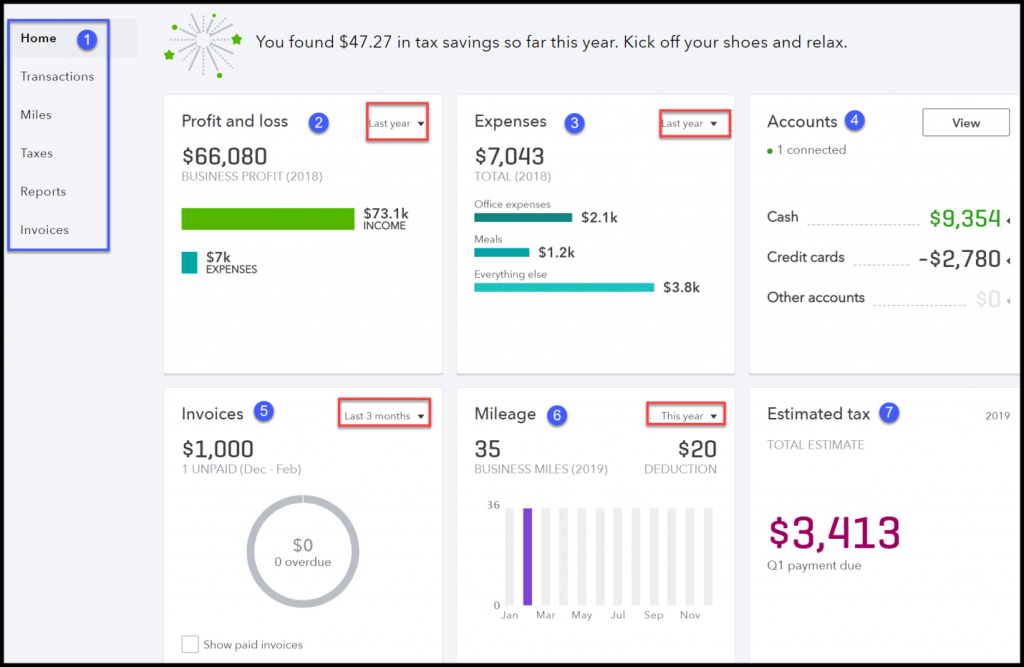

Business owners and solopreneurs use this software to separate their business expenses from their personal expenses.

You can track vehicle expenses, home office deductions, healthcare expenses, office supplies, equipment purchases, and more.

If you haven’t put much thought into which business expenses you should be deducting as a freelancer, check out this article for ideas.

Users also take advantage of the available accounting features, although it must be said that QuickBooks Self-Employed is primarily tax software with some accounting tools added.

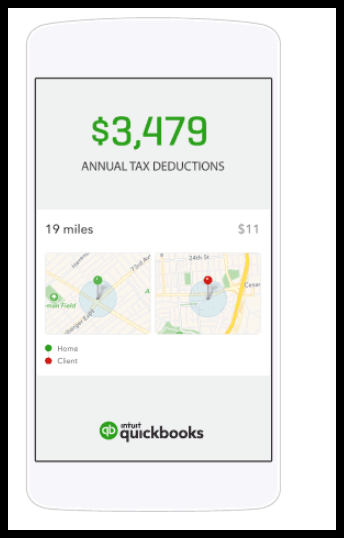

If you’re a driver, you can plug the software directly into Google to enable location-tracking, which makes mileage tracking super easy.

With QuickBooks Self-Employed, you can use the mobile app to scan receipts and track expenses (no more throwing receipts into a box in your closet!)

One of the most magical features is the OCR technology they use to automatically scan your receipts and input the data automatically – no more manually punching numbers into Excel!

The software also has some bookkeeping capabilities, which helps you as a solopreneur to get insight into your business – especially the numbers side of things.

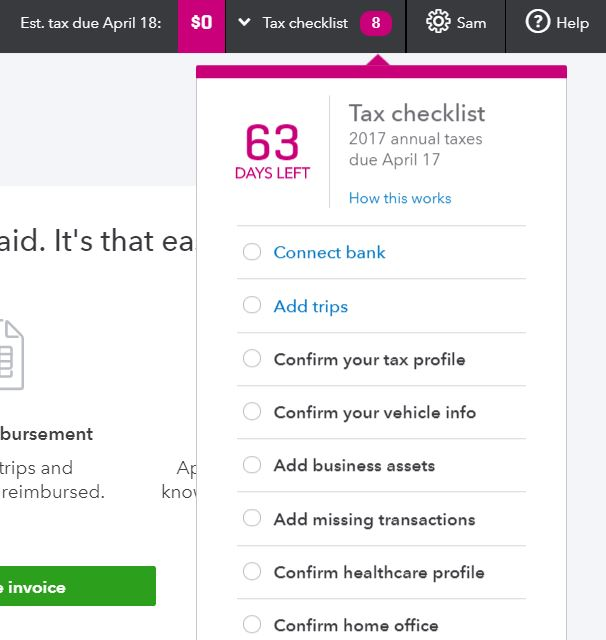

You can pay estimated quarterly taxes and file federal and state income tax returns (if applicable) right from the app.

The tax reporting also lets you pay your estimated quarterly taxes online – how convenient is that!

The system also gives you with a handy Tax Checklist to give you peace of mind.

You can also add your logo to invoices, send payment reminders, and even accept payments online using QuickBooks Payments.

QuickBooks Self-Employed also gives you a client portal that clients can use to view and pay invoices online. You can send receipts after the client has paid you for your services.

You can even track your business assets with the Asset Management feature as well.

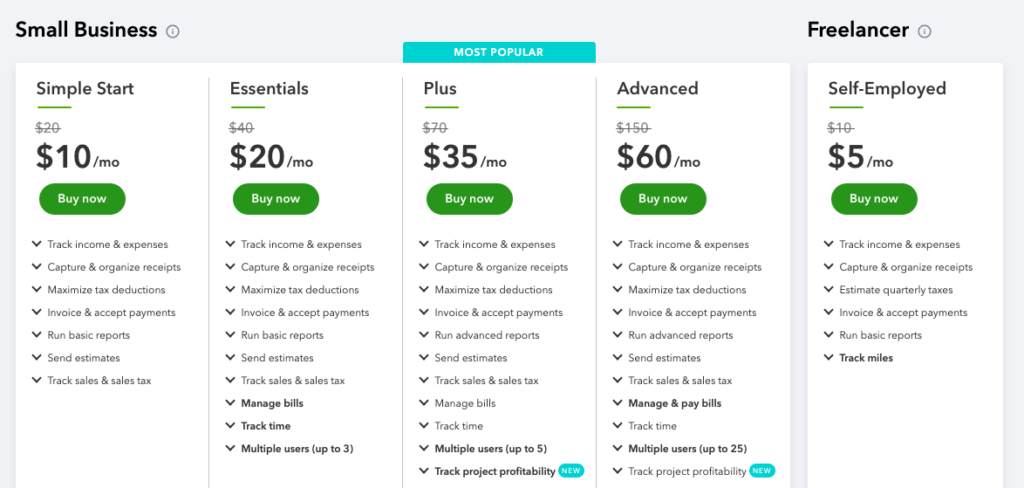

PRICING

You can get the software for only $10 per month, or $17 per month if you’re opting for the Tax Bundle (which includes TurboTax integration, another Intuit product).

Now that we’ve covered the basics of what QuickBooks Self-Employed helps you accomplish and what’s included, let’s talk about some of the key features that are missing in this software that are essential for most small business owners.

FEATURES NOT INCLUDED IN QUICKBOOKS SELF-EMPLOYED

As we know, QuickBooks Self-Employed is a back office tool.

For the accounting enthusiasts out there, you’ll find that QuickBooks Self-Employed doesn’t offer true double-entry accounting, but for most solo-preneurs this is a minor setback.

Here are some functions you may need that QuickBooks Self-Employed won’t be able to provide:

- Contact Management

- Inventory Tracking

- Business Messaging

- Invoicing (over 10 per month)

- Invoice Customizations

- Send Invoices thru SMS

- Sales Tax support

- Send Estimates

Here’s how you can double down on your business productivity – use PocketSuite to handle everything listed above and make your life easier.

PocketSuite is a tool that allows you to run the entire front-end of your business from a single app.

You can export data from PocketSuite and upload it to QuickBooks, which is how the majority of Pros using PocketSuite prefer to do it.

In fact, here’s what some industry Pros using PocketSuite say about the 1-tap experience:

“OMG… I just tapped one button in PocketSuite and all my data is right in QuickBooks… like the old Staples quote goes, that was easy!!”

Jennifer R. – Dog Walker – Pasadena, CA

“…I itemized all of my travel expenses in my invoices so I can just put those into QuickBooks…”

Robert W. – Limo Driver – New York, NY

So how can PocketSuite help your business succeed beyond what QuickBooks Self-Employed can help you with? There are so many additional functions you can turn on, we’ll take them one by one.

PocketSuite allows you to…

- Manage your business Contacts (add notes separate from your personal contacts)

- Track your Inventory (with smart reminders to replenish stock when necessary)

- Handle Business Messaging (so you can run your business over text)

- Take care of Invoicing (unlimited # of invoices)

- Make Invoice Customizations (fully customizable)

- Send Invoices thru SMS (so your clients actually receive it promptly and you get paid within 24 hours instead of having to wait 14 to 30 days)

- Sales Tax support (no more manual calculations on your part – put away that calculator!)

- Send Estimates (thru SMS as well)

It’s never been easier to put your business on auto-pilot. Now you’ll be able to export your data to QuickBooks Self-Employed so you can manage your expenses, track your mileage, and file your taxes with ease.

It really is as easy as 1 tap in the app.

Let PocketSuite do the heavy lifting while you go build your empire!

In fact, if you haven’t tried PocketSuite, there’s a Premium FREE Trial that’s beckoning for you to give it a shot. You can download the app here and get set up in minutes!

Like this article? You’ll love our guide on how to generate leads for service businesses in 2022, and of course our Frustrations with Square article!