Okay, this is a doozy. Most folks that start a small business or are solopreneurs are definitely not comfortable with accounting (very few people in the world are – seriously, who understands that stuff?) Sadly, because of how important accounting is for businesses (especially new ones) it can be a real Achilles heel for business owners who don’t manage their books because they don’t have basic understanding of their numbers.

In the end, your business is all about numbers – numbers about how much you make, how much you keep, and how much you give to the “Man.”

No, not the Man in the castle in the sky, I’m talking about the Tax man!

And if you just got a rush of anxiety, it’s because you’re not abiding by this simple rule:

“Clarity brings confidence.”

In other words, it’s time to dispel the fog and wade into the murky waters of your business numbers. We’re going to take a plunge into what’s actually going on in your business, and hopefully resurface more knowledgeable and equipped with a game plan to make you even more successful.

So you’ve heard of Quickbooks – it’s probably the most recognizable small business solution for accounting on the planet.

You’ve maybe even reviewed some online tutorials on how to use Quickbooks and your eyes have started to crisscross and glaze over. I can’t blame you, the same thing happened to me!

That’s why in this article we’ll discuss very simply how to do basic accounting for your business in Excel.

No need for an accounting degree – let’s investigate how you can easily track your business finances using just one (1) excel sheet.

We’ll also dig into how you can actually use PocketSuite to track your financials as well, and how this is a happy compromise between Pen and Paper (are we in the stone age – why not just break out the abacus?) and Quickbooks (I’m getting brain damage as we speak).

SOLUTION #1: EXCEL

Step 1 is to open Excel or Google Sheets and create a new sheet.

Name the overall spreadsheet something like “[YOUR BUSINESS NAME] FINANCIALS” or, if you prefer something more practical and less formal like “[YOUR BUSINESS NAME] PERFORMANCE”

Now name this first sheet “Expenses”

Step 2 is to create the following columns:

- Expense

- Expected

- Actual

Viola, we just created your first expense sheet!

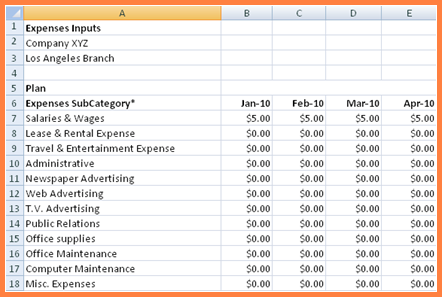

Just list your monthly expenses here, one in each row. If you’d like to break things apart by month you can do that as well, similar to this:

The next step is to create a TOTAL column and put this formula into it:

=SUM(B1-B8) (assuming row B is your expenses that you’re summing up, and you have 8 rows of expenses. If you have more, just replace the 8 with however many rows you have)

And now you should be able to automatically see your totals for expenses.

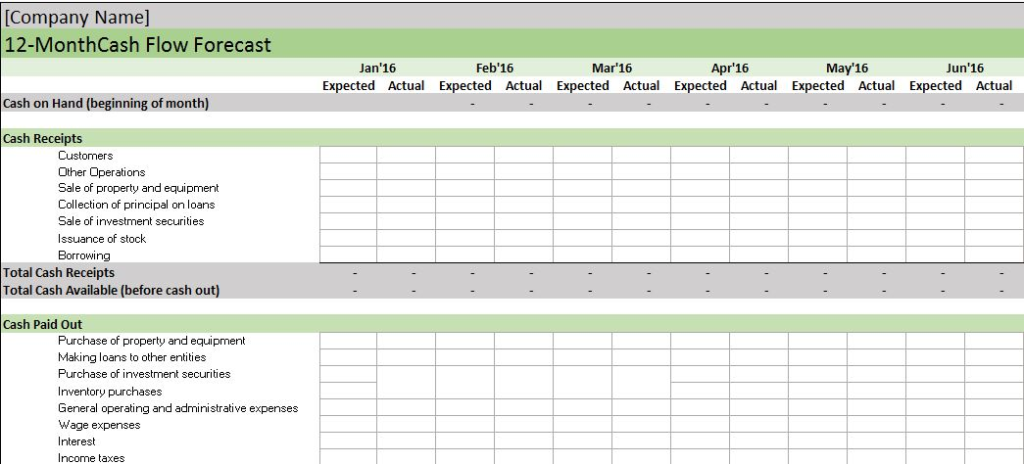

Here’s another example with Expected and Actuals broken down by month:

Step 3 is to create another sheet, but this time name it Income.

You’ll also create similar column names:

- Income

- Expected

- Actual

You can use this sheet to track all of your income from your clients.

You may want to create additional column names for client info, or just paste from your Client List spreadsheet (outlined in our Client Lists article).

Are you getting dizzy yet? I’m not done! Don’t worry, I’ll provide a much simpler solution at the end of this article so stick with me!

SOLUTION #2: PEN AND PAPER

If excel is too much for you, you may want to try Pen and Paper.

This is an outdated method and also less secure than storing everything in the cloud (what if you spill coffee on it? I know you’re drinking coffee to try and stay awake as you read through these steps…)

However, for those of us that weren’t born holding a computer mouse or phone, it may be a more comfortable approach to dealing with your finances.

The method to do this is similar – you just take some graph paper (or even better, an actual ledger than you can get at any office supply store) and fill it out with the same column names that I mentioned above.

The drawbacks of this method are that:

1. You constantly have to manually update your financial statements

2. Your records aren’t as safe and secure (from coffee spills) as they would be in the cloud

3. Your records aren’t portable. (Unless you want to stuff yet another thing into your go-bag.)

If you’re scratching your head because neither of these options seem like the quick-fix that you were hoping for, don’t worry! There is still hope for you, young padawan.

What am I talking about? (besides the Star Wars reference, you should know that)

PocketSuite’s user-friendly system for helping service professionals keep track of their finances, of course.

How does this magic work? It’s easy, actually. In fact, it’s the perfect middle ground between being a dinosaur (Pen and Paper) and having a brain aneurysm (Quickbooks).

How does it work, you might wonder?

Quite simple, to be clear. In fact, it might be the easiest option on this list.

SOLUTION #3: POCKETSUITE

How does PocketSuite help you to manage your finances?

The answer: auto-magically.

You see, when you use PocketSuite to manage your business (we’re talking about client lists, payments, scheduling, messages, and almost everything else) you’re already keeping track of these numbers.

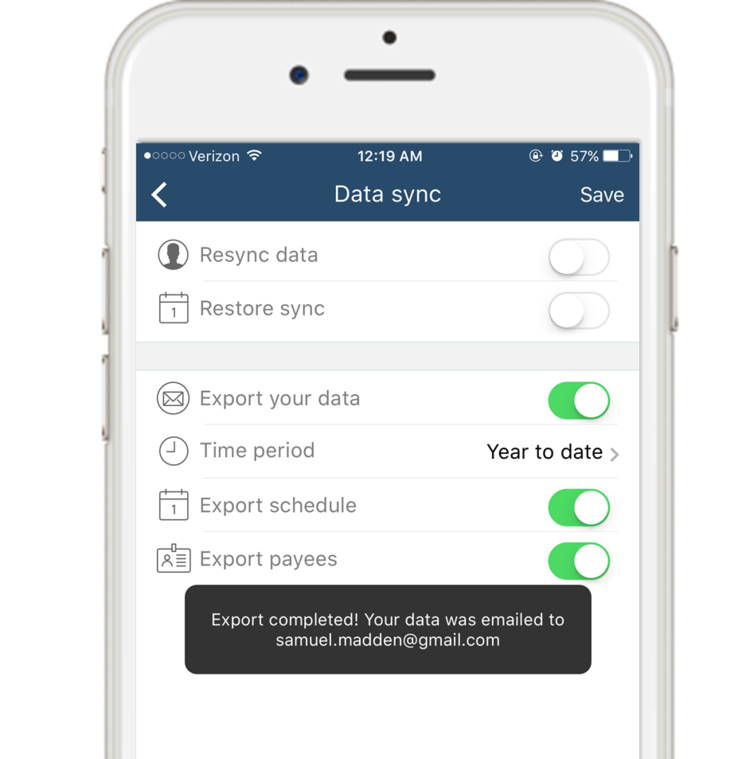

Simply export your data in a few taps by navigating to Settings -> Help & Admin -> Data Sync.

Boom, that’s it! You can easily get data like Payment Deposits, Invoices Sent and Paid, Appointments Scheduled, and even Client Details in Excel (or CSV) form emailed right to your inbox.

No more searching through your Pen and Paper records or Excel to find the right info. No more plugging in values into Excel, cross referencing with your client records, as tears of boredom streak down your face…

Just export your data with PocketSuite and you already have the grunt work done for you.

Now it’s time to focus on what’s really important – get more clients and grow your business!

No need to go out and get an accounting degree, or worry about bookkeeping any longer.

And if you still want to use Quickbooks, no worries! You can take your exported data from PocketSuite and plug it right into Quickbooks.

I hope it has become clear that there’s no need to go through the pain and suffering of manually keeping track of your business finances with either Excel or Pen & Paper.

Your bookkeeping woes are all in the past and your business future shines bright and glorious. With a warm glow you fondly recall the memories of manually calculating your monthly income (with an actual calculator), but only for a moment, as you gracefully turn towards the future.

If you follow the advice in this article, you will step into a new world of automation and save oodles of time with PocketSuite as your faithful servant and cheerleader.

Don’t underestimate the minutes, that turn into hours, days, and weeks of your precious life, slipping away in pointless drudgery. This may seem unnecessarily contemplative, and somewhat pompous, but it’s an uncontroversial reality to claim these wasted moments will eventually become how you’ve lived your life. (Deep, I know.)

So consider your choices carefully. If you can automate something like accounting and bookkeeping, then for your own life’s sake you bloody well should!

Now I may be a shameless advocate of automation, but that doesn’t make me any less right. Go out there and build your systems, so you can conquer your business and lead it to success under the flagship of a focused and unrelenting leader!

If you enjoyed this article, do yourself a favor and go give PocketSuite a try. The Premium and Team subscription has a 30-Day FREE Trial. 10,000 small business owners have already experienced the power of automating your accounting and bookkeeping – now it’s your turn.

Like this article? You’ll love our guide on how to generate leads for service businesses in 2022, and of course our Frustrations with Square article!