AND WHY IT’S A HUGE DEAL FOR SMALL BUSINESSES.

I’m going to try my best to have an unbiased view of Square Up. It’s tough, however, to not be partisan when I talk with small businesses every single day who complain about the costs, malfunctioning card readers, and unresponsive Square support.

Don’t get me wrong – I think Square Up is perfect for specific industries like retailers, restaurants, and food trucks because of its ease of use. With a Square account, you can collect payments, schedule appointments, and more. You even get a free Square card reader. Square Capital can give businesses in these industries the small business loans and capital they need to get up and running. Square Up works well for businesses with retail locations, but it’s got a lot of limitations for service-based businesses.

For many of the service professionals that I speak to each day (like therapists, estheticians, stylists, personal trainers, yoga/pilates instructors, dog trainers, cleaners, coaches, contractors, tutors, and more), Square Up tends to have a number of key issues. The feedback is simple: It can be really, really, really frustrating.

Here are some of the common complaints we hear about Square.

High, Complicated Costs & Fees

The Square Point of Sale system makes it easy for businesses to accept credit cards. And payments are deposited in your bank account within 1-2 business days. But the biggest limitation to accepting credit cards is high fees. Most business owners can relate to that. Cash flow is very important to small business owners, so keeping costs simple and low is a must. The pricing structure for companies like Square Up, Authorize.net, American Express, and even PayPal are still stuck in the stone ages.

There are processing fees, per-transaction fees, batch fees, hardware fees, monthly gateway fees, setup fees, and more. The unspoken truth is in the fine print, unfortunately.

To make things even more complicated, the fee structures are different depending on how you accept payment. A swipe? An online payment? An invoice payment? A card entry? Most on-the-go business professionals don’t want to have to stop and think about how much in fees they’ll be paying based on how their clients will be paying using their credit card or debit card.

Innovations in payment processing technology have accelerated in recent years. That means these processors should not be confusing their customers with complex pricing schedules. There should be a single transaction fee…a low transaction fee.

It shouldn’t be this complicated.

Hardware is Necessary

When a client is paying for services, the customer is not always directly in front of the professional. Most of the businesses we speak to each day are invoicing clients, collecting deposits, accepting online bookings/payments – they need more than point of sale credit card processing through Square Register.

Square is best known for its swiping – when the client is right in front of the business owner. Because of this, hardware (or the “Square reader”) is mandatory in order to perform the very act of swiping a credit card in person (or inputting a card into a larger reader if EMV chips are involved).

In our “attempt” at humor, we published a Top 10 Ways to Ditch Your Square Reader…highlights include attaching your reader to a SpaceX rocket ship or planting it in your backyard to see what grows 🙂

Ok, back to the serious stuff like the problems with hardware. The hardware can break. It doesn’t plug in if you have a smartphone case. You can’t ever seem to remember to pack it. The hardware doesn’t store the card information of your recurring clients.

Credit card readers make sense at a Starbucks, restaurant, or in a food truck. After all, card readers can only be used in a single situation – in person. Most on-the-go professionals need more than that.

Feature Overload

Square Up touts how it helps service businesses “run their business”. But in the real world, there are limitations to that marketing message – you need more than just a credit card processor to run your business.

For example, here’s some feedback we received from Tim who runs a fitness business:

“I am using Square Up for processing (@3.5% + $0.15 for manually entered), use Google Calendar, use Zoho for billing, and have to run monthly credit card payments manually.”

So for Tim to run his business, he needs more tools (than just Square Up) with more features. He uses up to 5 other apps and tools to help him with the day to day.

To address this problem, Square has also invested in building adjacent tools and (supposedly) complementary apps.

Here’s a quote we received from Susan who runs a small tutoring business in Texas. Let me know if you can guess what her issue might be here:

“I use the Square Cash app, Square Appointments, Square Invoices, and Square Payments via my website.”

She uses more Square tools than just a credit card processor. However, she uses 4 different Square apps to help her run all the parts of her business.

She spends most of her time hopping in and out of each Square-built app – in many ways not any real difference from Tim’s problem above. The Square apps are not integrated, they don’t sync, and they each cost their own ongoing monthly fees or transaction fees.

A lot of frustration comes from the fact that Square Up is a payment processing company at its heart, and business owners are having fundamental issues using Square to “run their entire business”.

“I can’t get anyone from their support team on the phone!”

If I’m using Instagram, and I run into a bug or have a question, I don’t necessarily panic. I’ll email Instagram’s support team with more of a “heads up” about the issue and not really lose sleep over it, and definitely do not expect to get someone on the phone to discuss the issue.

Why? Because I don’t rely on Instagram to survive (i.e., collect payment for my business). But for business tools, high-quality/real-time support is something that is absolutely crucial.

What if your client is having trouble paying you? You can’t charge a credit card? You’re waiting on a deposit and want to know when it will arrive? All of a sudden your reader breaks?

Square Up has limited phone support. That means the busy professional can’t speak to a real human being on demand…A human with real feelings who can be empathetic about the fact that they’re trying to run a real business, collect payments and are experiencing a serious roadblock.

Am I Being Too Harsh?

I honestly don’t think so. My concerns here aren’t made up. These are concerns that I’m echoing from real business owners, with actual concerns, who are trying to each build something awesome – their own business.

Square Up is not the future of small business technology. It’s the past. Most single small business owners don’t have a voice loud enough to make a significant change in technology. So it’s on us to voice their concerns, address their issues, and come up with a practical solution.

Get PocketSuite – The Best Square Up Alternative

Square Up is a popular option for businesses because it’s been around for so long. However, as a legacy system, it can’t keep up with the needs of modern small businesses. That’s why we created PocketSuite. PocketSuite is the #1 App for anyone with clients. We make it easy for your clients to regularly book and pay you. Even better, we give you the tools you need to grow your business.

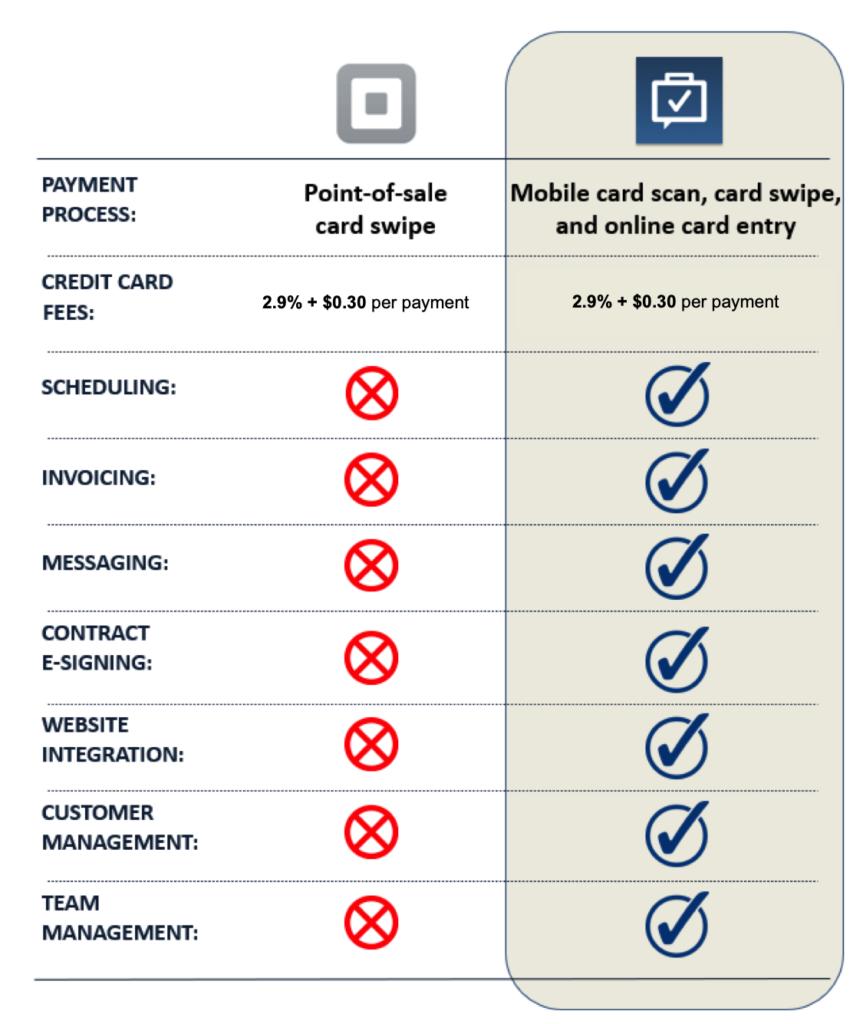

See the table below to see how PocketSuite compares to Square Up.

AND WHY IT’S A HUGE DEAL FOR SMALL BUSINESSES. I’m going to try my best to have an unbiased view of Square Up. It’s tough, however, to not be partisan when I talk with small businesses every single day who complain about the costs, malfunctioning card readers, and unresponsive Square support.

Don’t get me wrong – I think Square Up is perfect for specific industries like retailers, restaurants, and food trucks because of its ease of use. With a Square account, you can collect payments, schedule appointments, and more. You even get a free Square card reader. Square Capital can give businesses in these industries the small business loans and capital they need to get up and running. Square Up works well for businesses with retail locations, but it’s got a lot of limitations for service-based businesses.

For many of the service professionals that I speak to each day (like therapists, estheticians, stylists, personal trainers, yoga/pilates instructors, dog trainers, cleaners, coaches, contractors, tutors, and more), Square Up tends to have a number of key issues. The feedback is simple: It can be really, really, really frustrating.

Here are some of the common complaints we hear about Square.

High, Complicated Costs & Fees

The Square Point of Sale system makes it easy for businesses to accept credit cards. And payments are deposited in your bank account within 1-2 business days. But the biggest limitation to accepting credit cards is high fees. Most business owners can relate to that. Cash flow is very important to small business owners, so keeping costs simple and low is a must. The pricing structure for companies like Square Up, Authorize.net, American Express, and even PayPal are still stuck in the stone ages.

There are processing fees, per-transaction fees, batch fees, hardware fees, monthly gateway fees, setup fees, and more. The unspoken truth is in the fine print, unfortunately.

To make things even more complicated, the fee structures are different depending on how you accept payment. A swipe? An online payment? An invoice payment? A card entry? Most on-the-go business professionals don’t want to have to stop and think about how much in fees they’ll be paying based on how their clients will be paying using their credit card or debit card.

Innovations in payment processing technology have accelerated in recent years. That means these processors should not be confusing their customers with complex pricing schedules. There should be a single transaction fee…a low transaction fee.

It shouldn’t be this complicated.

Hardware is Necessary

When a client is paying for services, the customer is not always directly in front of the professional. Most of the businesses we speak to each day are invoicing clients, collecting deposits, accepting online bookings/payments – they need more than point of sale credit card processing through Square Register.

Square is best known for its swiping – when the client is right in front of the business owner. Because of this, hardware (or the “Square reader”) is mandatory in order to perform the very act of swiping a credit card in person (or inputting a card into a larger reader if EMV chips are involved).

In our “attempt” at humor, we published a Top 10 Ways to Ditch Your Square Reader…highlights include attaching your reader to a SpaceX rocket ship or planting it in your backyard to see what grows 🙂

Ok, back to the serious stuff like the problems with hardware. The hardware can break. It doesn’t plug in if you have a smartphone case. You can’t ever seem to remember to pack it. The hardware doesn’t store the card information of your recurring clients.

Credit card readers make sense at a Starbucks, restaurant, or in a food truck. After all, card readers can only be used in a single situation – in person. Most on-the-go professionals need more than that.

Feature Overload

Square Up touts how it helps service businesses “run their business”. But in the real world, there are limitations to that marketing message – you need more than just a credit card processor to run your business.

For example, here’s some feedback we received from Tim who runs a fitness business:

“I am using Square Up for processing (@3.5% + $0.15 for manually entered), use Google Calendar, use Zoho for billing, and have to run monthly credit card payments manually.”

So for Tim to run his business, he needs more tools (than just Square Up) with more features. He uses up to 5 other apps and tools to help him with the day to day.

To address this problem, Square has also invested in building adjacent tools and (supposedly) complementary apps.

Here’s a quote we received from Susan who runs a small tutoring business in Texas. Let me know if you can guess what her issue might be here:

“I use the Square Cash app, Square Appointments, Square Invoices, and Square Payments via my website.”

She uses more Square tools than just a credit card processor. However, she uses 4 different Square apps to help her run all the parts of her business.

She spends most of her time hopping in and out of each Square-built app – in many ways not any real difference from Tim’s problem above. The Square apps are not integrated, they don’t sync, and they each cost their own ongoing monthly fees or transaction fees.

A lot of frustration comes from the fact that Square Up is a payment processing company at its heart, and business owners are having fundamental issues using Square to “run their entire business”.

“I can’t get anyone from their support team on the phone!”

If I’m using Instagram, and I run into a bug or have a question, I don’t necessarily panic. I’ll email Instagram’s support team with more of a “heads up” about the issue and not really lose sleep over it, and definitely do not expect to get someone on the phone to discuss the issue.

Why? Because I don’t rely on Instagram to survive (i.e., collect payment for my business). But for business tools, high-quality/real-time support is something that is absolutely crucial.

What if your client is having trouble paying you? You can’t charge a credit card? You’re waiting on a deposit and want to know when it will arrive? All of a sudden your reader breaks?

Square Up has limited phone support. That means the busy professional can’t speak to a real human being on demand…A human with real feelings who can be empathetic about the fact that they’re trying to run a real business, collect payments and are experiencing a serious roadblock.

Am I Being Too Harsh?

I honestly don’t think so. My concerns here aren’t made up. These are concerns that I’m echoing from real business owners, with actual concerns, who are trying to each build something awesome – their own business.

Square Up is not the future of small business technology. It’s the past. Most single small business owners don’t have a voice loud enough to make a significant change in technology. So it’s on us to voice their concerns, address their issues, and come up with a practical solution.

Get PocketSuite – The Best Square Up Alternative

Square Up is a popular option for businesses because it’s been around for so long. However, as a legacy system, it can’t keep up with the needs of modern small businesses. That’s why we created PocketSuite. PocketSuite is the #1 App for anyone with clients. We make it easy for your clients to regularly book and pay you. Even better, we give you the tools you need to grow your business.

See the table below to see how PocketSuite compares to Square Up.

AND WHY IT’S A HUGE DEAL FOR SMALL BUSINESSES. I’m going to try my best to have an unbiased view of Square Up. It’s tough, however, to not be partisan when I talk with small businesses every single day who complain about the costs, malfunctioning card readers, and unresponsive Square support.

Don’t get me wrong – I think Square Up is perfect for specific industries like retailers, restaurants, and food trucks because of its ease of use. With a Square account, you can collect payments, schedule appointments, and more. You even get a free Square card reader. Square Capital can give businesses in these industries the small business loans and capital they need to get up and running. Square Up works well for businesses with retail locations, but it’s got a lot of limitations for service-based businesses.

For many of the service professionals that I speak to each day (like therapists, estheticians, stylists, personal trainers, yoga/pilates instructors, dog trainers, cleaners, coaches, contractors, tutors, and more), Square Up tends to have a number of key issues. The feedback is simple: It can be really, really, really frustrating.

Here are some of the common complaints we hear about Square.

High, Complicated Costs & Fees

The Square Point of Sale system makes it easy for businesses to accept credit cards. And payments are deposited in your bank account within 1-2 business days. But the biggest limitation to accepting credit cards is high fees. Most business owners can relate to that. Cash flow is very important to small business owners, so keeping costs simple and low is a must. The pricing structure for companies like Square Up, Authorize.net, American Express, and even PayPal are still stuck in the stone ages.

There are processing fees, per-transaction fees, batch fees, hardware fees, monthly gateway fees, setup fees, and more. The unspoken truth is in the fine print, unfortunately.

To make things even more complicated, the fee structures are different depending on how you accept payment. A swipe? An online payment? An invoice payment? A card entry? Most on-the-go business professionals don’t want to have to stop and think about how much in fees they’ll be paying based on how their clients will be paying using their credit card or debit card.

Innovations in payment processing technology have accelerated in recent years. That means these processors should not be confusing their customers with complex pricing schedules. There should be a single transaction fee…a low transaction fee.

It shouldn’t be this complicated.

Hardware is Necessary

When a client is paying for services, the customer is not always directly in front of the professional. Most of the businesses we speak to each day are invoicing clients, collecting deposits, accepting online bookings/payments – they need more than point of sale credit card processing through Square Register.

Square is best known for its swiping – when the client is right in front of the business owner. Because of this, hardware (or the “Square reader”) is mandatory in order to perform the very act of swiping a credit card in person (or inputting a card into a larger reader if EMV chips are involved).

In our “attempt” at humor, we published a Top 10 Ways to Ditch Your Square Reader…highlights include attaching your reader to a SpaceX rocket ship or planting it in your backyard to see what grows 🙂

Ok, back to the serious stuff like the problems with hardware. The hardware can break. It doesn’t plug in if you have a smartphone case. You can’t ever seem to remember to pack it. The hardware doesn’t store the card information of your recurring clients.

Credit card readers make sense at a Starbucks, restaurant, or in a food truck. After all, card readers can only be used in a single situation – in person. Most on-the-go professionals need more than that.

Feature Overload

Square Up touts how it helps service businesses “run their business”. But in the real world, there are limitations to that marketing message – you need more than just a credit card processor to run your business.

For example, here’s some feedback we received from Tim who runs a fitness business:

“I am using Square Up for processing (@3.5% + $0.15 for manually entered), use Google Calendar, use Zoho for billing, and have to run monthly credit card payments manually.”

So for Tim to run his business, he needs more tools (than just Square Up) with more features. He uses up to 5 other apps and tools to help him with the day to day.

To address this problem, Square has also invested in building adjacent tools and (supposedly) complementary apps.

Here’s a quote we received from Susan who runs a small tutoring business in Texas. Let me know if you can guess what her issue might be here:

“I use the Square Cash app, Square Appointments, Square Invoices, and Square Payments via my website.”

She uses more Square tools than just a credit card processor. However, she uses 4 different Square apps to help her run all the parts of her business.

She spends most of her time hopping in and out of each Square-built app – in many ways not any real difference from Tim’s problem above. The Square apps are not integrated, they don’t sync, and they each cost their own ongoing monthly fees or transaction fees.

A lot of frustration comes from the fact that Square Up is a payment processing company at its heart, and business owners are having fundamental issues using Square to “run their entire business”.

“I can’t get anyone from their support team on the phone!”

If I’m using Instagram, and I run into a bug or have a question, I don’t necessarily panic. I’ll email Instagram’s support team with more of a “heads up” about the issue and not really lose sleep over it, and definitely do not expect to get someone on the phone to discuss the issue.

Why? Because I don’t rely on Instagram to survive (i.e., collect payment for my business). But for business tools, high-quality/real-time support is something that is absolutely crucial.

What if your client is having trouble paying you? You can’t charge a credit card? You’re waiting on a deposit and want to know when it will arrive? All of a sudden your reader breaks?

Square Up has limited phone support. That means the busy professional can’t speak to a real human being on demand…A human with real feelings who can be empathetic about the fact that they’re trying to run a real business, collect payments and are experiencing a serious roadblock.

Am I Being Too Harsh?

I honestly don’t think so. My concerns here aren’t made up. These are concerns that I’m echoing from real business owners, with actual concerns, who are trying to each build something awesome – their own business.

Square Up is not the future of small business technology. It’s the past. Most single small business owners don’t have a voice loud enough to make a significant change in technology. So it’s on us to voice their concerns, address their issues, and come up with a practical solution.

Get PocketSuite – The Best Square Up Alternative

Square Up is a popular option for businesses because it’s been around for so long. However, as a legacy system, it can’t keep up with the needs of modern small businesses. That’s why we created PocketSuite. PocketSuite is the #1 App for anyone with clients. We make it easy for your clients to regularly book and pay you. Even better, we give you the tools you need to grow your business.

See the table below to see how PocketSuite compares to Square Up.

Hear what customers about switching from Square Up to PocketSuite

App works awesome.

“I am a pro user. Was using Square and clients prefer PocketSuite. Customer service is top-notch too! Very responsive to issues.”

Michelle Duncan, 10/30/2018

Square is for squares. PocketSuite is for professionals

“I love this app. The creator must be a genius but it does everything for my Business. I upgraded to premium because I have a fitness center where clients book classes online and you can sync with employees etc. the customer service is so awesome, responds almost immediately through the app or email, phone. I hope this app stays forever because it helps my business run smoothly.”

Anonymous User, 06/15/2019

Best app, way better than Square

“This is the best app ever. Ha ha. I mean it really is though, I can run my whole business from my phone with ease and my clients love the ease of paying by text, e-signing contracts, and I love the low processing fee!

I cannot wait to see where this awesome team takes this app and cannot believe how great they are! The greatest and easiest customer service that I can reach within the app and get a lightning fast response! What!? Yep!

Download this! You can thank me later. ;)”

Skg1991, 07/17/2016