Accepting Payment

There are so many ways for you to accept payment from clients. From cash to cards to mobile payment apps, it has never been easier to ensure your business is paid promptly and smoothly after every appointment. Today, we’ll be covering the benefits of using a POS Card Reader for your phone.

You’ll also learn:

- What to watch out for when using card readers

- The history of this technology

- How you can best use it to benefit your small business

TAP, SWIPE, INSERT HERE, PLEASE

Have you ever been to a farmer’s market?

Have you ever purchased products or services from a solo business or small business?

If so, you’re already familiar with what a card reader is.

The technical term for this technology is ‘Payment Terminal.’ This is usually part of a Point of Sale System.

We wrote an entire article on POS systems, but today we zoom in on the benefits of using a POS System with hardware.

The portable version of this technology is affectionately known as a ‘Card Reader.’

Card readers are typically dongles that can be attached to any phone. Small businesses and freelancers use them to swipe credit or debit cards.

In this article, we’ll show you how to use this technology to accept cards for your small business.

We’ll also discuss the history of these convenient devices, potential pitfalls, and what makes PocketSuite’s card reader so awesome.

Get your RFID-proof foil hats on, because today’s discussion is going to be magnetic!

THE HISTORY OF CARD READERS

Did you know that the magnetic strip on your credit card was originally bonded to the plastic by heating it up with a household iron?

An IBM engineer was frustrated that none of his methods of bonding worked, until he came home and his wife suggested he use their iron to bond the magnetic strip to the card.

Before this invention, merchants used barbaric instruments called Charga-plates to accept payments.

These crude devices looked nothing like modern day credit or debit cards:

Later, Ron Klein invented the credit card strip, but made surprisingly little money from his patent.

EMV (Chip) cards are the most recent development in the card payment space.

Originally created in the late 90’s, ‘Chip Cards’ have since become the standard for card payments.

Today, there are over 600 Million payment cards in circulation, and this number is growing every day.

In fact, Mastercard Advisors did a survey that showed that 80% of American’s spending was cashless in 2013.

This trend isn’t going away and small business owners are taking notice.

If your business is able to accept credit cards, you immediately become an easier person for potential clients to do business with.

PROBLEMS WITH CARD READERS

With such widespread use of credit cards, it should not be surprising that there have been some security concerns related to these convenient devices.

In 2018, one study showed that magnetic strip technology exposed card owners to bluetooth-based attacks and remote access vulnerabilities.

Fortunately, the problem was corrected when the software that runs these swipers was fixed.

Overall, swipers have proven to be safe and secure.

They are also incredibly convenient for your clients. Let’s find out why:

BENEFITS OF CARD READERS

CONVENIENCE

Imagine being responsible for paying a vendor, but not having any cash.

What do you do in this situation?

Previous generations of folks would scramble to find an ATM or sheepishly offer to write a check.

However, nowadays most small businesses and freelancers are able to accept credit and debit cards via a Card Reader on their phone.

Simply hand your card over to the merchant, watch them insert, tap, or swipe it on the fob attached to their phone, and then sign on their phone using your finger.

It couldn’t be easier to collect payment from clients and run your business smoothly.

SECURITY

Clients think card readers on the phone are more secure than taking a picture of their credit card.

If a merchant takes a picture of your card, you’re running the risk of them inputting the wrong amount when they go to charge the card later.

You also don’t see the transaction in your bank statement until the next day, which gives scammers time to make a clean getaway.

Additionally, with the relatively recent iPhoto security breaches, keeping card information on your Camera Roll may not be the most secure option.

SPEED

If you are a small business, freelancer, or solo business that processes a high volume of client payments, you’ll also benefit from the speed of collecting payments using a Card Reader on your phone.

Instead of accepting cash and giving out change to clients, using a bulky cash register, you can simply swipe and go.

There are also no checks to collect, which run the risk of bouncing when you deposit them later.

ANONYMITY BENEFITS

Using credit or debit cards allows customers to pay for services relatively anonymously.

Unlike handing a check to the merchant, there’s no personal info to divulge with a simple swipe.

There is a certain anonymity that comes with swiping – clients don’t have to share their address or phone number with you.

Simply insert, tap, or swipe the card and let the card terminal process the payment.

This leaves no room for scam merchants to potentially memorize the client’s card number, cvv code, and expiration date.

It also keeps the client’s location hidden in case there is a dispute or problem related to the transaction.

HOW TO BEST USE CARD READERS IN YOUR BUSINESS

There is a right way and a wrong way to do just about everything.

Choosing a Card Reader for your phone and your business is no different.

In our article entitled ‘What Frustrates Me About Squareup’, we discussed the pitfalls of a popular Card Reader from Square.

The reality is, there’s a much better way to process your client’s cards to accept payments.

Enter PocketSuite.

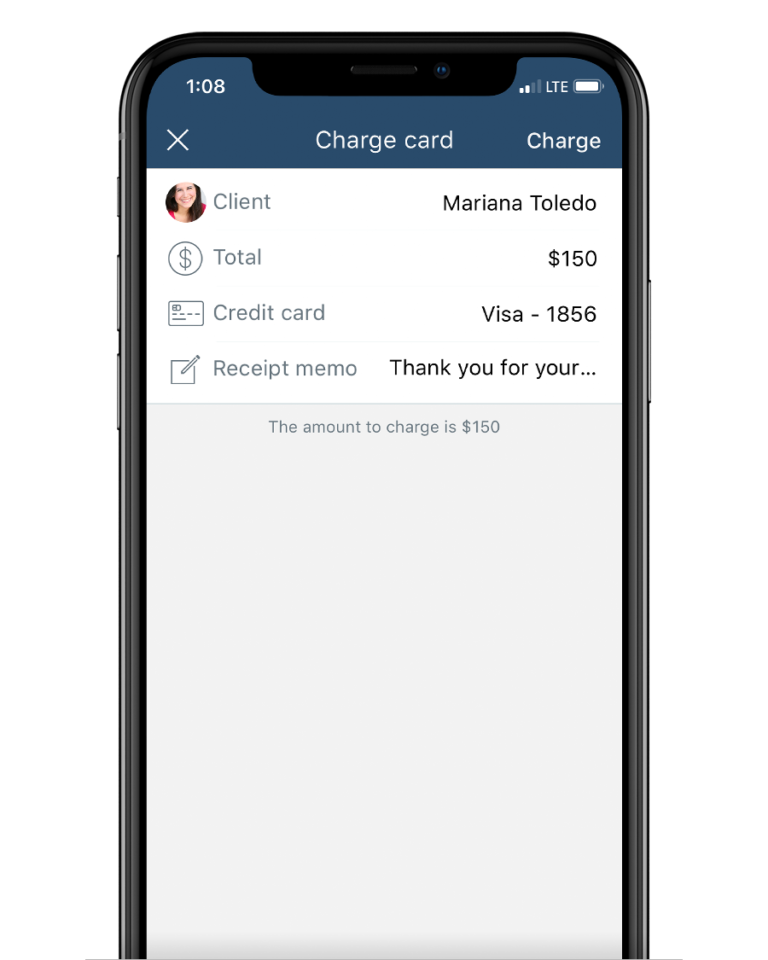

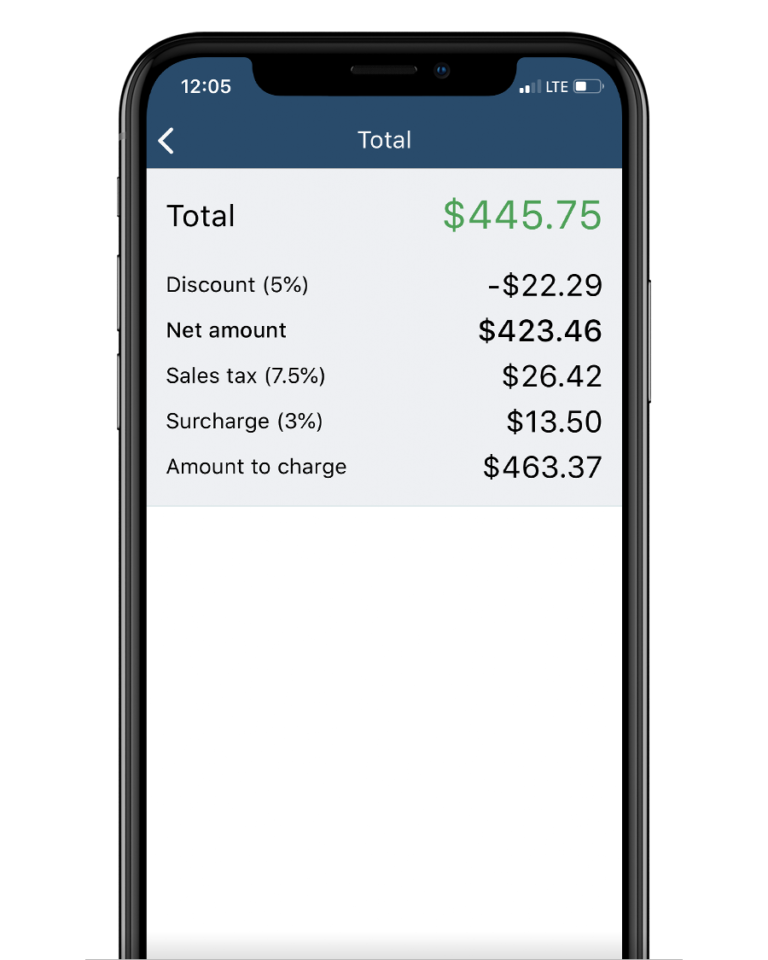

Let’s say your customer hands you a card to charge:

- You enter the amount you’d like to charge into PocketSuite.

- You swipe, insert, or tap it using PocketSuite’s Card Reader on your phone.

That’s it!

The card is stored for future charging, which makes recurring appointments a breeze.

If that was it, PocketSuite wouldn’t be much different than other Card Readers on the market.

Here’s what makes PocketSuite different:

Since you can use PocketSuite to manage your entire business from 1 app, now that you’ve inserted, tapped, or swiped, you can also:

- Connect the payment to any sent invoice or scheduled appointment

- Store the client’s card on file for future charging

- Use the low payment processing fee – lower than you’ll find anywhere else!

What about if you’re selling products and have inventory?

PocketSuite has an entire inventory management system that allows you to keep track of your products.

It will even alert you when you’re running low by giving you a reminder to stock up again.

It’s no wonder why the ASCP recommends PocketSuite as their go-to app!

START ACCEPTING CARDS TODAY

If you’ve thought about whether you should accept credit cards in your service business, now is the time.

Your customers want it and it will make your life super easy.

Join the tens of thousands of pros using PocketSuite to accept credit and debit cards in their small business.

Check out PocketSuite’s free trial to get you started and start swiping cards today!

Like this article? You’ll love these articles:

- PocketSuite Point of Sale

- Our guide on how to generate leads for service businesses in 2022

- Our Frustrations with Square article