PocketSuite is an all-in-one scheduling tool for service-based businesses. We want to see your business grow, which is why we’ve made accepting payments a priority. Every business is different, so PocketSuite offers multiple ways to get paid, no matter how you run your business!

Here are all the ways business owners can get paid on PocketSuite:

- Point-of-sale

- Invoicing

- Deposits

- Post-service payments

- Online payments

- Selling packages

- Subscriptions

- Class deposit

- vis SMS shortcode

- Cancellation fees

- Client app

- Gift certificates

- Payment button

- Card reader

- Stripe link

- Tap to pay

- Online products

- Buy now, pay later

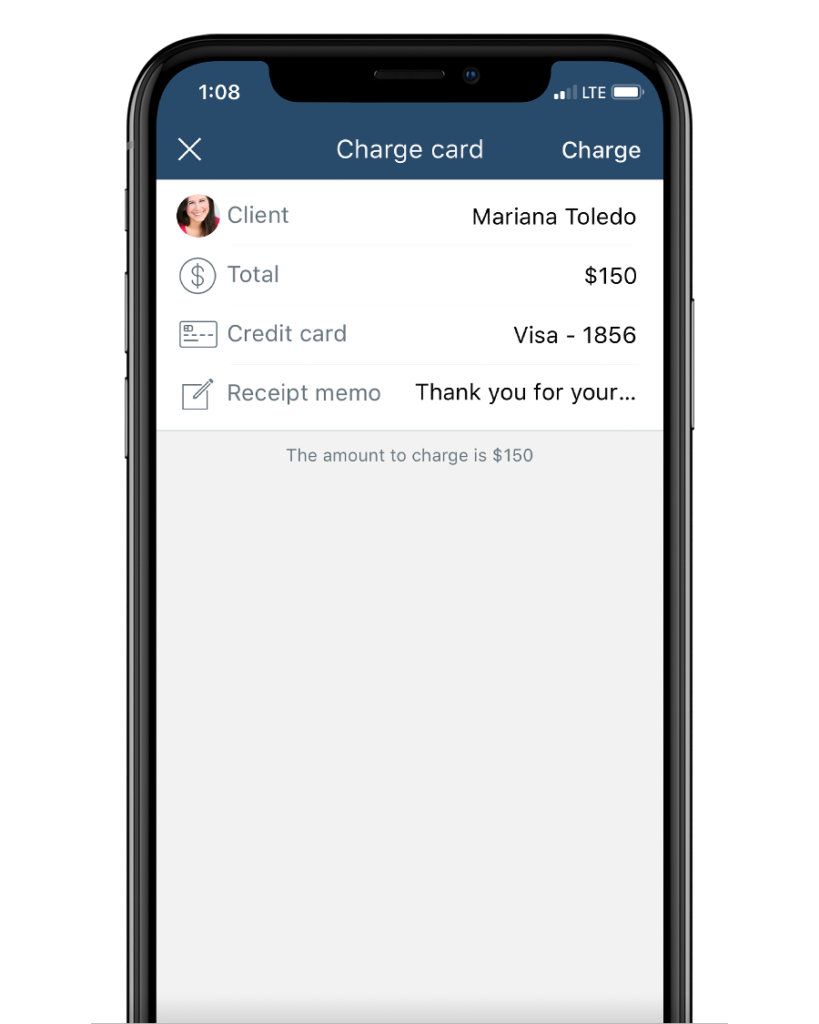

#1 Point-of-Sale

Occasion: Quick way to charge a client’s card if they hand it to you or simply tell you the card details over the phone.

Benefits: Fast! Also you can store the client’s card for future charging at will.

How: Tap the CHARGE button on your home screen of PocketSuite, enter client CC info, charge any $ amount. Save on processing fees at 2.9% + 30¢ per payment, compared to Square or PayPal.

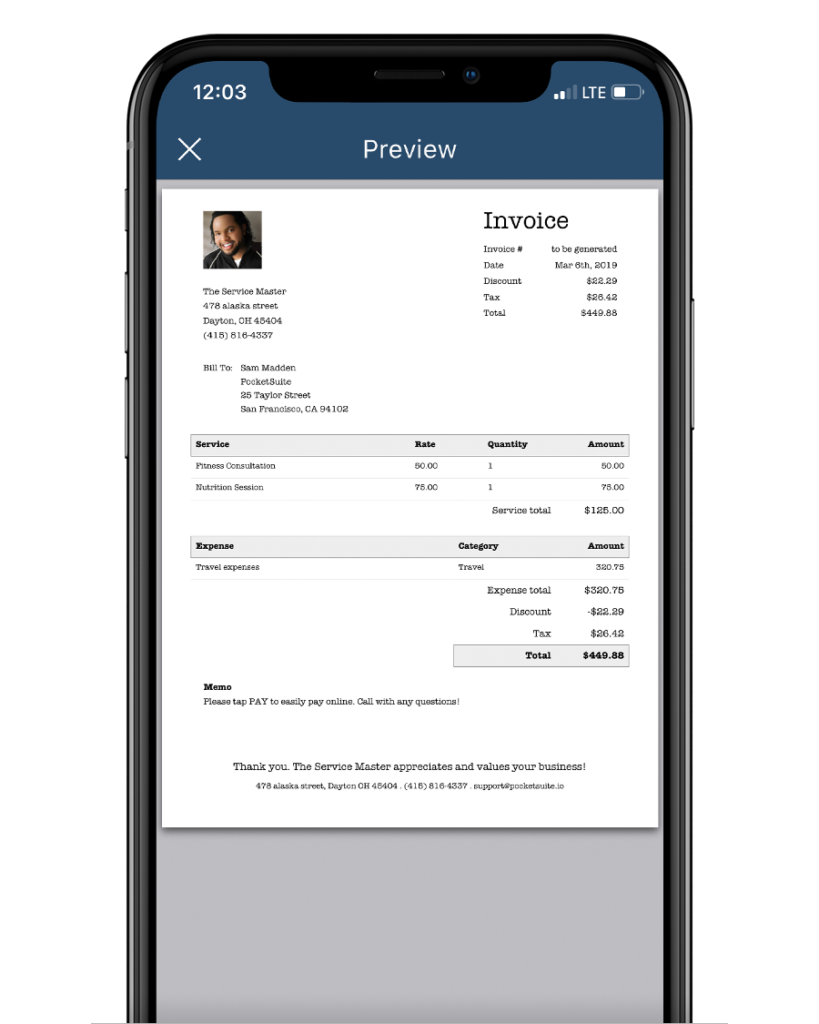

#2 Invoicing

Occasion: Sending a traditional (and professional) invoice to clients for services.

Benefits: Allows clients to pay any invoice amount online (from their smartphone or computer) with convenience.

How: Tap the INVOICE button on your home screen of PocketSuite. Deliver any invoice via text or email, and clients will have the option to pay online.

#3 Deposits

Occasion: If you want to collect payment on an appointment upfront when scheduling a client to your calendar.

Benefits: In one-fell swoop, confirm a client appointment on your calendar while receiving a full or partial $ deposit upfront.

How: When scheduling an appointment in PocketSuite, set a “$ Deposit” amount on the appointment and require your client to confirm said appointment with a credit card when you send it to them.

#4 Payment once an Appointment/Job is Complete

Occasion: When you want to accept payment immediately after an appointment is complete.

Benefits: Uber-like experience to charge a client’s card that is linked to an appointment on your calendar.

How: Tap the CHARGE button on any appointment on your calendar that has been reserved with a client’s credit card. You can charge any $ amount and even hand the phone over to your client to add a tip (if desired).

#5 Online Payments

Occasion: If you want to have clients book/pay you online – you can accept payment through your website, Facebook page and Instagram profile.

Benefits: Allows you to turn anyone visiting your website or social media pages into an instantly booking and paying client.

How: Enable ‘Online Booking’ in PocketSuite, and integrate your booking widget onto your website. Then paste your booking links on your social media profile.

#6 Selling Packages

Occasion: If you want to sell upfront to a client a group or package of services/classes for future use.

Benefits: Collecting payment upfront, and then having a simple way to track all the sessions/credits used by each client.

How: Set up / save any standard package or program you sell, then send it off to your client (via text or email) to review and then purchase online. Credits are auto-added to the client’s account and you can start tracking those sessions!

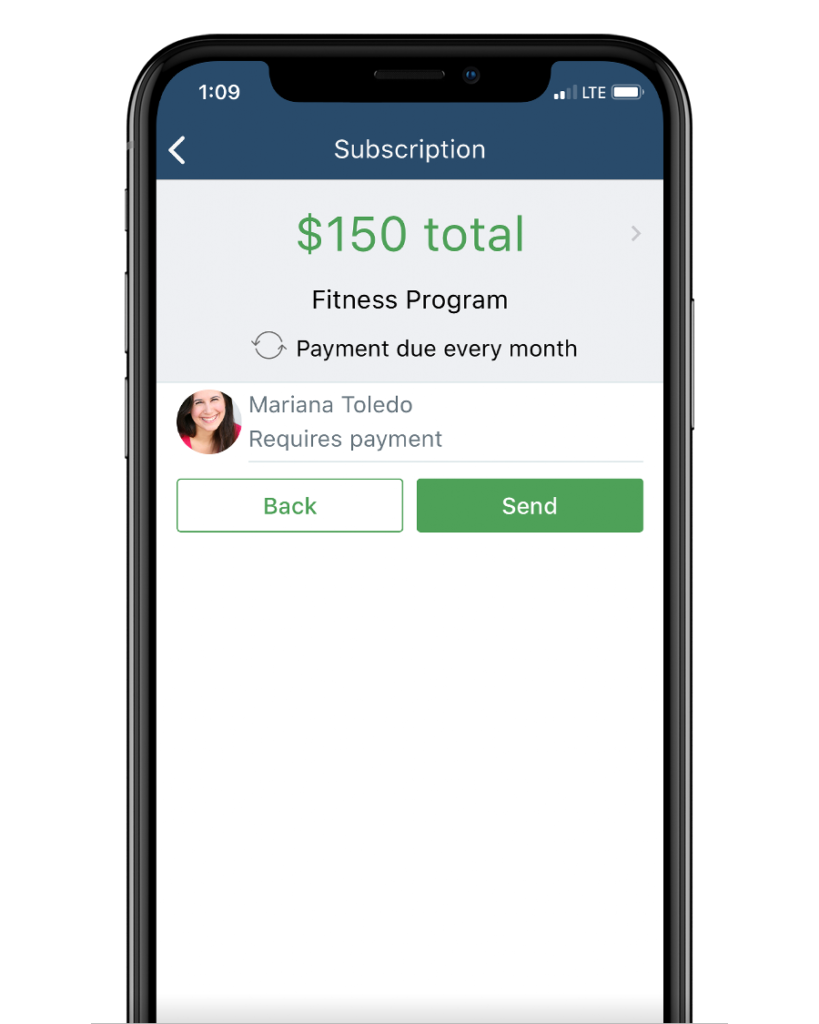

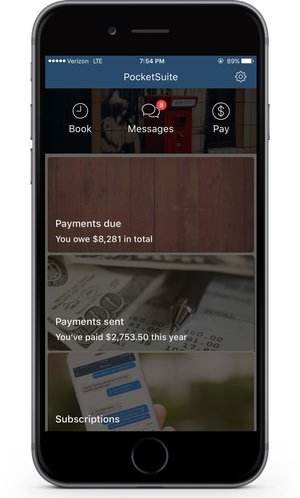

#7 Recurring Payments

Occasion: When you need to automatically charge clients each week, month, etc. – for ongoing memberships or recurring billing.

Benefits: Literally get paid while you sleep. No work on your end to have to invoice/charge clients, and no work on the client’s end to have to remember to pay an ongoing bill.

How: Enable ‘Subscriptions’ in PocketSuite, and send any type of subscription plan you’d like to a client (with a set $ amount and payment schedule). Your client confirms that plan just ONCE with a credit card only and voila!

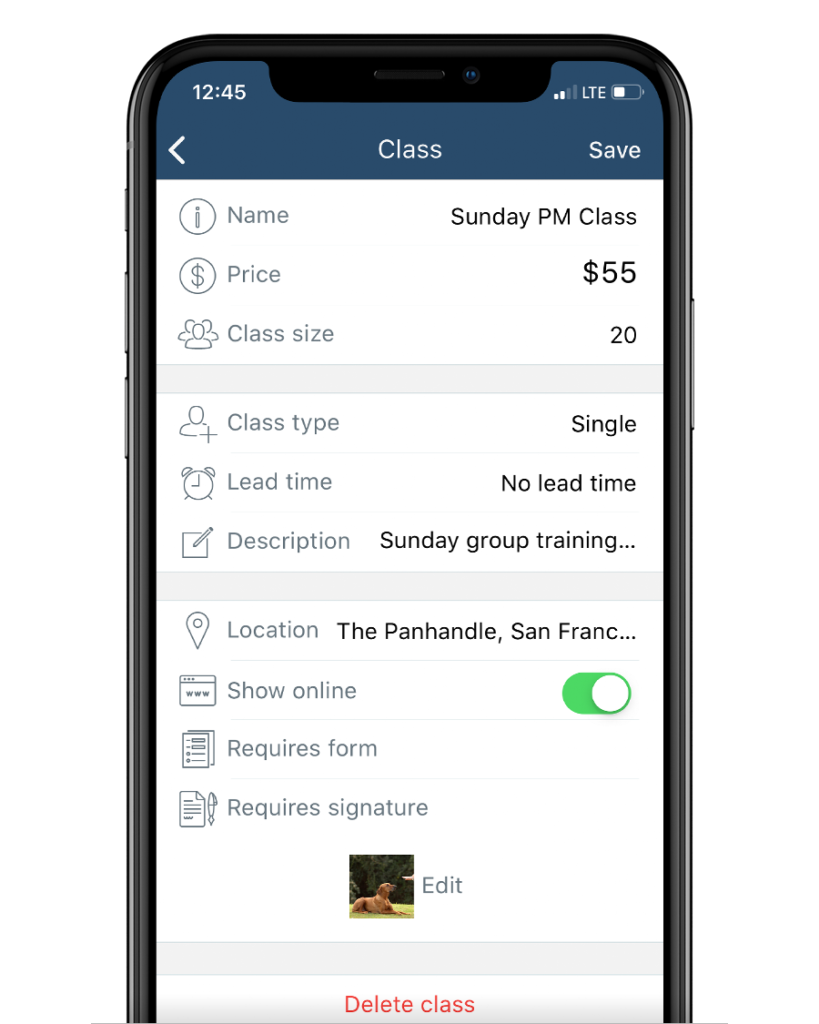

#8 Class Deposit

Occasion: When you want clients to sign up for a class and pay a drop-in fee ahead of a class.

Benefits: Double whammy: fills up your class roster allowing clients to sign up for a class ahead of time, and ensures you get PAID for the class ahead of time.

How: Enable ‘Classes’ in PocketSuite, then set up your class schedule (class name, $ drop-in, schedule, location, etc.). You can sign clients up yourself or post your class schedule online (see ‘Online Booking’ above) for clients to sign up & pay online.

#9 via SMS Shortcode

Occasion: When you are requesting payment from a client via SMS text (i.e., sending an invoice via text, a package via text, requesting a job deposit via text, etc.), clients can literally just reply “1” to pay.

Benefits: Literally the easiest way around for a client to make a payment.

How: If you send any payment request to a client via text message, then your client will be given the option in the text thread to “Reply 1” to pay whatever is due (assuming your client already has entered a CC on file before).

#10 Cancellation Fee

Occasion: If your client ever cancels an appointment falling inside your cancellation window.

Benefits: Gives you the ability to charge a cancellation fee — so you can be compensated for clients who fail to show up or cancel on you last minute.

How: When a client taps on their appointment link and hits the CANCEL button, they will be shown that by cancelling, their card (on file) will be charged your cancellation fee (as set by you under Settings > Business > Cancellations).

#11 Client App

Occasion: If your client wants more control over sending you one-off payments not tied to any particular transaction.

Benefits: Gives your clients more flexibility and an organized record of all payments they send to you as the business.

How: Clients can download PocketSuite to their smartphones as well – they create a ‘client’ account instead of a ‘business’ account. They can add your business details under their PocketSuite contacts and send you payment at will via credit card, debit card and even ACH transfer.

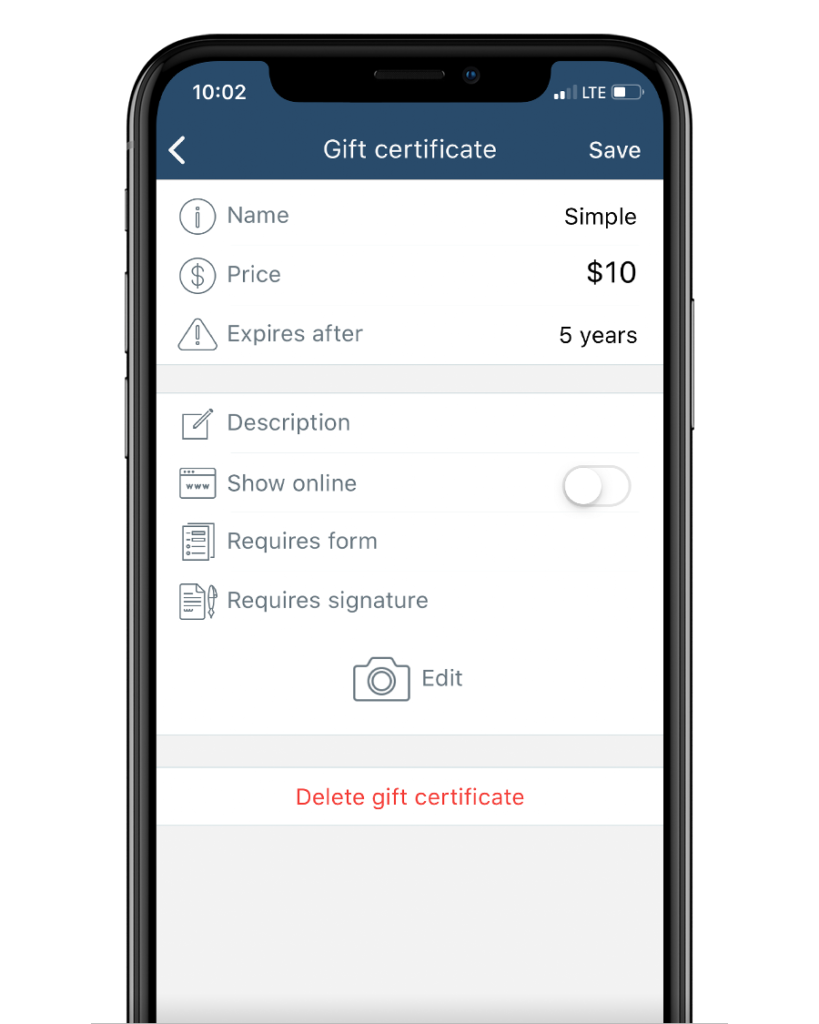

#12 Gift Certificates

Occasion: For holidays, special occasions, or just because…

Benefits: Gives you the ability to sell anyone an e-gift card that can be assigned to anyone as a gift and used to pay for any of your services. It’s a great way to pull your income forward during slow periods.

How: When a client taps on your booking link to buy any of your gift card items, they can purchase it for themselves or assign it before checking out of your booking site by entering the name, number, and a brief message to anyone.

#13 Payment Button

Occasion: Whenever from whomever

Benefits: Gives you the ability to securely get paid any amount by anyone from your website or social media page (Facebook, Instagram, YouTube, LinkedIn, Twitter, etc.).

How: Just like Venmo and PayPal. when a client taps on the payment button or link on your website or social media, they can enter the amount that they want to pay and a quick note and send. You’ll be notified of the funds immediately and you can cash out in minutes.

#14 Card Reader on Mobile and Desktop apps

Occasion: If you prefer not to use your phone to accept payments in person

Benefits: Card readers are super portable and offer flexibility and security to your clients.

How: You can connect a physical card reader to your PocketSuite account. Charge clients for any service or product at any time with a card swipe or by inserting the chip into a POS card reader.

#15 Stripe Link

Occasion: For online booking and product orders

Benefits: Stripe Link auto-fills your customers’ payment information to create an easy and secure checkout experience. According to Stripe, you can increase your conversion rates by over 7% with this payment method.

How: Customers can choose to save their payment information at checkout. Stripe Link instantly populates customers’ saved payment details when they enter their email addresses, allowing them to check out quickly.

#16 Tap to pay

Occasion: When you want to accept payments without extra hardware

Benefits: You can accept payments quickly and securely with just your mobile phone.

How: All you need is a compatible Android device or iPhone. Then, you can accept physical contactless credit and debit cards or digital wallets when you charge clients in the PocketSuite app.

#17 Online Products

Occasion: If you offer retail products to clients

Benefits: You can earn extra income from retail product sales without having clients book an appointment.

How: You can set up an e-commerce store right on your PocketSuite booking site! Just add products to your account, and we will help you manage order fulfillment and payments. Plus, if you have services that pair well with a product, you can upsell those products when clients book your services online.

#18 Buy Now Pay Later

Occasion: When your clients need more flexibility to pay for invoices, packages, and product orders

Benefits: You can offer clients 0% interest financing with up to three approved Buy Now Pay Later providers, including Afterpay, Klarna, and Affirm. Businesses that use BNPL attract more clients and see higher conversion rates!

How: All you have to do is toggle on Buy Now Pay Later in Settings. Clients will be able to select their preferred BNPL provider when they go to pay for an invoice, check out a package through online booking, or purchase a product from your online store.