From contractors to photographers… if you are a service professional, you’re likely familiar with online invoices, as they are a really common tool for collecting payment. You also likely know that you have so many options for online invoicing at your fingertips. Simply searching ‘invoice’ on Google gives 353,000,000 results – more than enough options to choose from. And then some!

So if you’re looking for an online invoicing solution, what criteria are you going to use to decide on which is best for your business?

Are you going to choose one that’s connected to an accounting system (QuickBooks comes to mind)?

Or would you rather go for a standalone online invoicing solution?

A third option would be to choose an invoicing app that allows for smart invoicing, i.e. one that’s already part of your suite of client management tools.

Today, we’ll be discussing the benefits of each and how you should go about making your decision.

WHAT IS AN ONLINE INVOICE?

If you are from the “Land of the Living” (shameless Game of Thrones reference), you probably already know what an invoice is.

For those of us who have been out of the loop, an online invoice is a statement issued by a business to a client that includes the details of the transaction.

Don’t confuse invoices with Purchase Orders (POs) – POs are typically for before the transaction and they record a client’s order. Invoices, on the other hand, are for after the transaction and they record the delivery of the product or service.

The details usually include things like the date of the sale, which products or services were sold (sometimes including a description), the quantity purchased, and agreed-upon prices.

The contents of a typical invoice are so important, I’ll share more below…

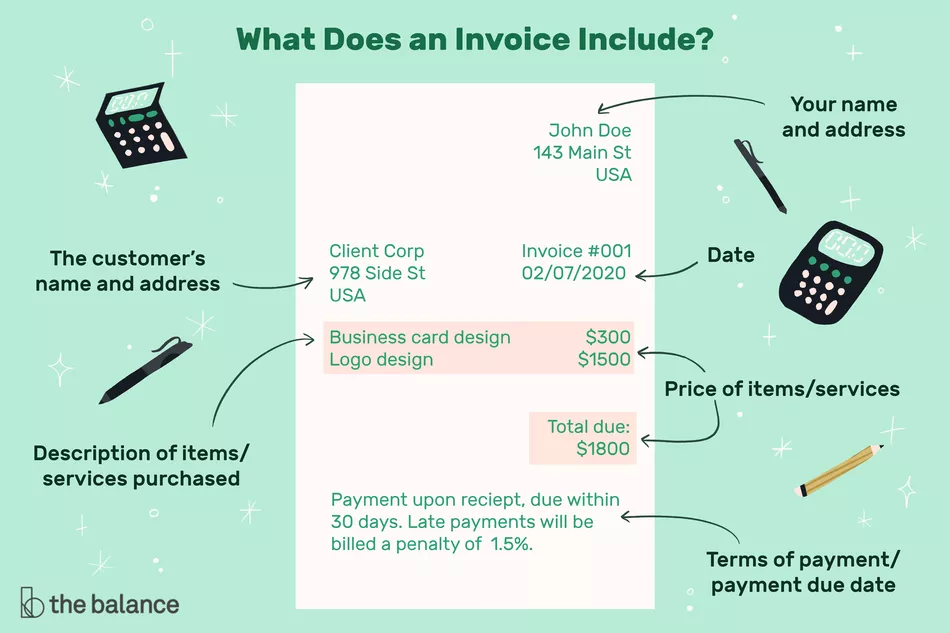

WHAT DOES AN INVOICE INCLUDE?

Source: The Balance SMB

Here are some common items that can be included on your online invoice (if they are relevant to your business):

- A unique reference number (to make correspondence easier)

- Date

- Tax

- Name and contact details of the service provider

- The service provider’s company details

- Name and contact information of the service provider

- Date that the product or service was delivered

- Purchase order number (or similar tracking numbers)

- Description of the products or services

- Prices of the products or services

- Total amount charged

- Payment terms (when payment is expected)

- Charges for late payments

A key ingredient of any good invoice is the payment term.

If you’ve ever heard of terms like ‘Net-15’ or ‘Net-30’ these indicate a time window (usually the number of days) that a service provider gives the client to pay an invoice.

For example, a Net-30 invoice gives the client 30 days to pay the service provider.

In some industries an invoice could also include the duration of time that the client is being billed for (such as in the rental industry).

HOW TO CHOOSE AN ONLINE INVOICING SOLUTION

As we’ve touched on previously, there are typically three different types of online invoicing solutions for the independent professionals:

- An online invoicing system that includes accounting (i.e. QuickBooks)

- A standalone invoicing system (i.e. Invoicely)

- An invoicing system that comes with software to manage your clients & run your business (i.e. PocketSuite)

Why don’t we break down the Pros and Cons of each?

AN ONLINE INVOICING SYSTEM THAT INCLUDES ACCOUNTING (i.e. Quickbooks)

PROS

- Your accounting system includes your sales history

- No need to Export sales data from your invoicing system and import into your Accounting system

CONS

- Your client bookings or purchase orders are tracked separately and online invoices have to be manually updated

- Your online invoices and client messaging are siloed on different platforms

- You can’t auto send online invoices for unpaid appointments

- You can’t attach contracts to your online invoices for e-signing

- You can’t link forms to your online invoices to be completed online

A STANDALONE ONLINE INVOICING SYSTEM (i.e. Invoicely)

PROS

- The least expensive option, sometimes free

CONS

- Your online invoices are in a different system from your client messaging

- Your appointment bookings are out of sync with your online invoices

- These types of free software companies sometimes sell your email address to spammers (no free lunch!)

- You can’t integrate any of your other client transactions (e.g. forms, contracts, saved messages)

INVOICING THAT COMES WITH SOFTWARE TO RUN YOUR BUSINESS (i.e. PocketSuite)

PROS

- You can automatically track the status of your online invoices and know when they’re paid

- You can send automatic payment reminders to your clients

- You have full-fledged reporting that integrates with your sales history

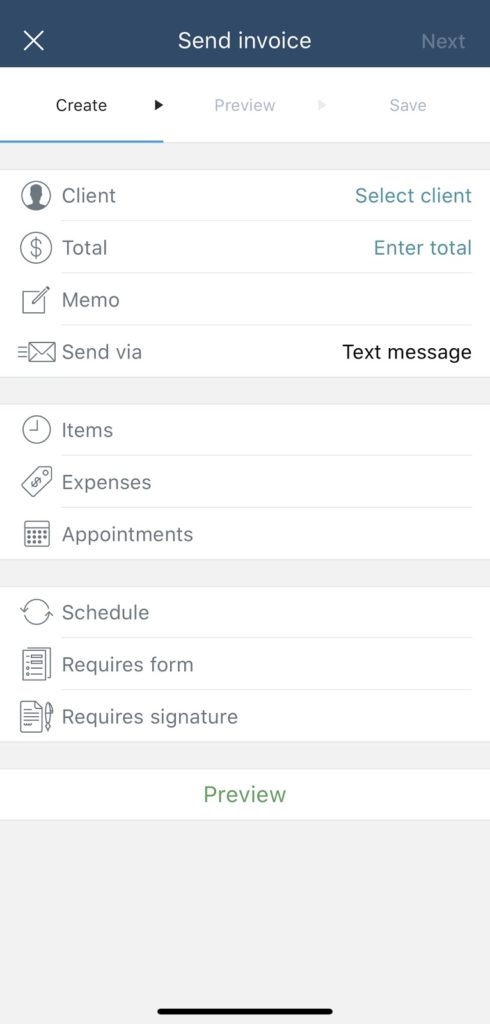

- You can send online invoices via text message or email

- You can attach online invoices to appointments on your calendar

- Your customers can pay your invoices online with a credit or debit card

- You can customize the online invoice with your logo

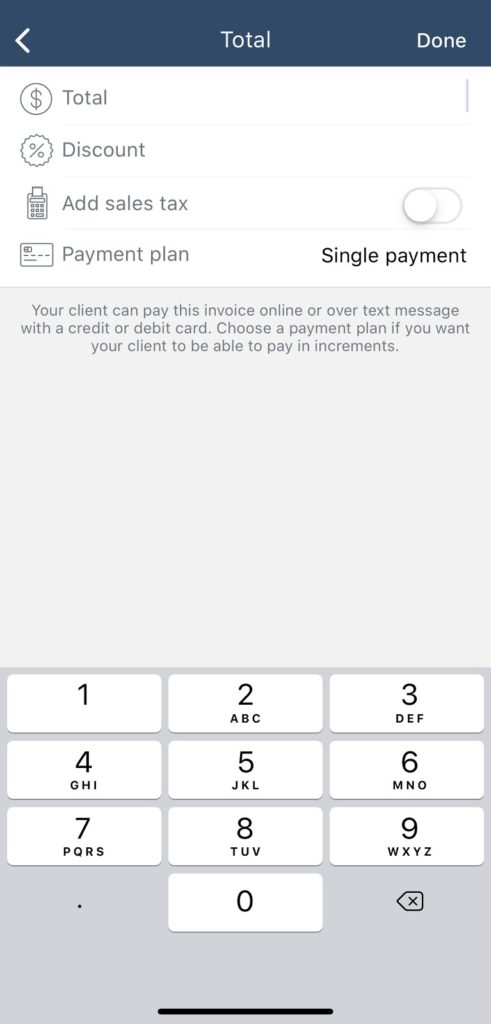

- You can add discounts and sales tax

- You can accept gratuity from clients

- You can itemize a bundle of client purchases

- You can itemize reimbursable expenses, including labor, mileage, and supplies

- You can add a form to an online invoice that your client can complete (i.e., intake form, client satisfaction survey, etc.)

- You can link a contract to your online invoice – client digitally signs before paying online invoice

- You can add a surcharge to pass on your payment processing fee as a credit card convenience fee

CONS

- You may have to pay money to access a premium online invoicing solution like this (Psst.. PocketSuite comes with all of these features and we have a free plan)

As a dazzling display of insight into the world of independent professionals and freelancers, PocketSuite displays yet another one of its many powerful features by bringing you Smart Online Invoicing.

No longer will you have to wait and wonder if your client has seen your online invoice – you’ll know with PocketSuite.

Neither will you have to keep sending payment reminders to your busy clients – PocketSuite has you covered there as well.

Further, consider that less and less clients are checking their email, causing them to potentially miss your online invoice completely (and to think of all that hard work you put in designing that beautiful invoice!)

This is no problem for a PocketSuite Pro because you have access to online invoicing via SMS.

Simply send an online invoice, and it will be delivered to your client via text message, automatically.

Not only that, but we go a step further by allowing your client to pay you with 1 tap.

Your client can whip out their credit or debit card and enter it to securely pay your invoice online.

There is a low card processing fee of just 2.9% + $0.30, with 1-2 business day direct deposit or instant payout to your debit card.

It’s never been easier for Pros to send online invoices via SMS or email to clients for payment.

It’s also simple enough to customize your online invoices, which makes your business look even more credible and professional.

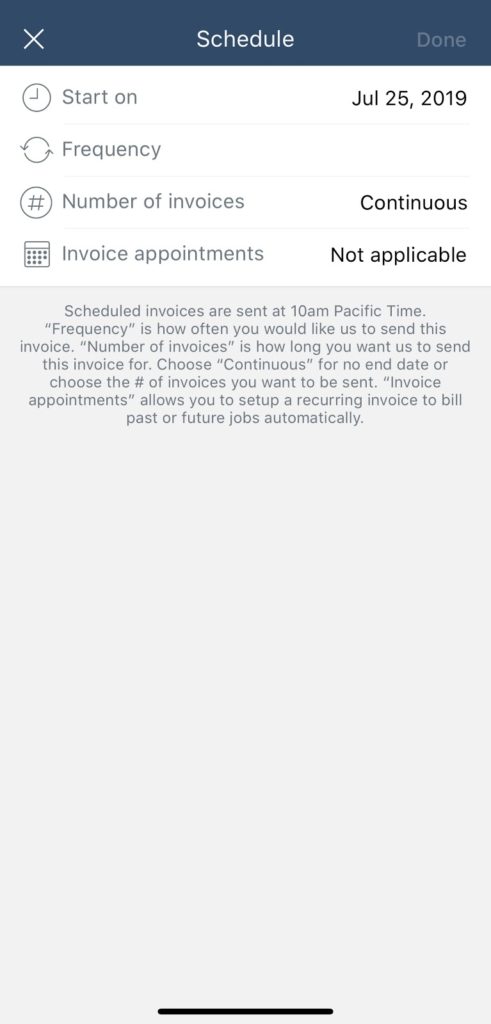

For professionals who want to set up recurring payments with clients, you can use a scheduled online invoice. A scheduled invoice (check it out in PocketSuite) automatically sends your clients invoices online based on timing that you set. Depending on how you invoice, as an option, you can also set a scheduled invoice to automatically include unpaid appointments as well as other unpaid products and services.

Here’s the best part, you can also customize pricing, include sales tax, discounts, and more. You can even add a surcharge and pass on the credit card processing fee to your clients, if necessary!

As if that wasn’t enough, you can also link your Contracts (available in PocketSuite) to your online invoices in order to make it super convenient for your clients.

This includes the ability to request instant contract signature by your client, which can be done conveniently online, including from your client’s phone.

That’s what I’d call an amazing combination of business power and consumer friendliness.

You’ll always be seen as the most professional service provider in your industry when you use PocketSuite – and that’s no accident.

Check out the free trial to get started using PocketSuite for all of your online invoicing needs!

Like this article? You’ll love these resources:

- PocketSuite Smart Invoicing

- Our guide on how to generate leads for service businesses in 2022

- Our Frustrations with Square article