“A deposit is required to book an appointment.” How many times have you seen this plastered on the terms and conditions of service providers’ websites or storefronts? Probably more than once, since it’s a powerful tactic that businesses have been using for decades to decrease no-shows, eliminate late cancellations, and protect your income from large swings.

Whether you’re a hairstylist, makeup artist, esthetician, dog trainer, or any other small business owner that operates by providing a service, you should be considering accepting deposits for your business.

In this review, we will share the following information about accepting deposits:

- Why deposits are a must-have for any solo business or small team

- Why accepting credit card deposits are far better than cash

- The way accepting deposits helps grow your revenue and reduce your cancellations and no-shows

First things first, what do you need to do in order to be able to accept deposits of any kind (legally)?

HOW TO SET UP YOUR BUSINESS TO ACCEPT DEPOSITS

Here are the rough preliminary steps you should take in order to be able to accept deposits:

- Set up your business bank account

- Obtain a Tax ID number (File IRS form SS-4)

- Set up your merchant account (or just set up a payment system like PocketSuite)

Seems fairly simple, right?

Now that you have a foundation for your business to accept deposits, let’s check out the mistakes that happen when business owners attempt to avoid using credit cards and instead accept cash.

You may not want to work with cash deposits for the following reasons:

FEES

To quote Chron:

“Many banks … have rules in place that require you to organize your bills in denominations from largest to smallest and to make sure that all of your bills are facing upward. You pay an extra surcharge if your bills are not presented in an orderly manner.”

Are you squinting to see if you read that right? Yes, you did. Banks can actually charge you a fee if you force them to organize all of your messy bills.

No thanks!

SECURITY

Either you need to bring large sums of cash to the bank every day, or you need to have a trusted employee (or two) help you out.

Either way, there’s a chance this can work out for the worst – the last thing you want to deal with is accidentally losing the money or possibly even theft.

EXTRA REPORTING & FORMS TO FILL OUT

If you’re depositing more than $10,000 in cash, the government even requires the bank to fill out an extra form called a Large Currency Transaction report.

This may mean you or your employees would have to answer additional questions. Often these questions can be personal in nature and not the most comfortable to reply to.

CORRECTIONS & DISCREPANCY

If you do an overnight drop-off at a bank, the tellers have to count the cash in your deposit in the morning and accept the amount that is in the bag.

If you counted wrong and you wrote the wrong amount on the deposit slip, you’re left with the discrepancy and may not notice it unless you check the deposit amount every morning and then make sure it’s the same number you wrote on the deposit slip the night before.

Sounds like an accounting nightmare!

In the next section, we’ll cover why accepting deposits will be one of the greatest things you can do for your business.

WHY YOU SHOULD ACCEPT DEPOSITS

Here are some benefits of getting paid up-front and accepting deposits:

CASH FLOW

The best thing about having positive cash flow is that you can reinvest the money into your business to grow faster.

Instead of waiting for clients to pay you (if they ever do), you can immediately have money in your account to pay for more marketing and get more clients.

Also consider out-of-pocket expenses – these you can reimburse yourself for, but with what money? Deposits can cover these easily.

Instead of depending on the goodwill and grace of your clients deciding to pay your invoices, require a deposit and keep your business running the way it should – like a cheetah, not a turtle!

FEWER NO SHOWS

One of the worst things about having an appointment-based business is when the client does a no-notice no-show.

Not only does this mean you’re missing out on the income from that client, but it’s frustratingly difficult to fill that seat with another client (with no lead time).

Since you’ve probably have some monthly expenses if your business involves any preparation, it will be doubly painful when your clients no-show because all of that prep time and money is wasted when your client doesn’t take your time seriously.

Accepting deposits forces clients to think twice before flaking on you – this will ensure you have a steady stream of income coming in to cover your monthly expenses and prevent you from having wild swings in your income.

Don’t let clients waste your time and money – requiring a deposit (even a small one) to book an appointment will ensure your clients have ‘skin in the game.’

Compare this to businesses where the service provider has recourse. Recourse is when a business has access to collateral (an asset of value owned by the client), which can be held if the client doesn’t deliver on their end of the bargain. If you’re a mechanic, you have the client’s car as collateral. If you’re a landscaper, you’re physically present at the customer’s property and can refuse to leave until you get paid. Well, squatting on a client’s property as a result of nonpayment is a bit extreme, but you get the spirit of the concept of recourse.

However, if you’re like most independent professionals, you have no recourse – accepting deposits are the missing piece that will help you. The deposit is your collateral.

LOWER CANCELLATIONS

Similar to no-shows, late cancellations are no fun to deal with because they hurt your business and your income.

Finding clients is expensive, so anything you can do to lower cancellations will keep your income strong.

Preventing late cancellations is yet another reason you should be accepting deposits in your business, starting today!

HOW TO ACCEPT DEPOSITS WITH POCKETSUITE

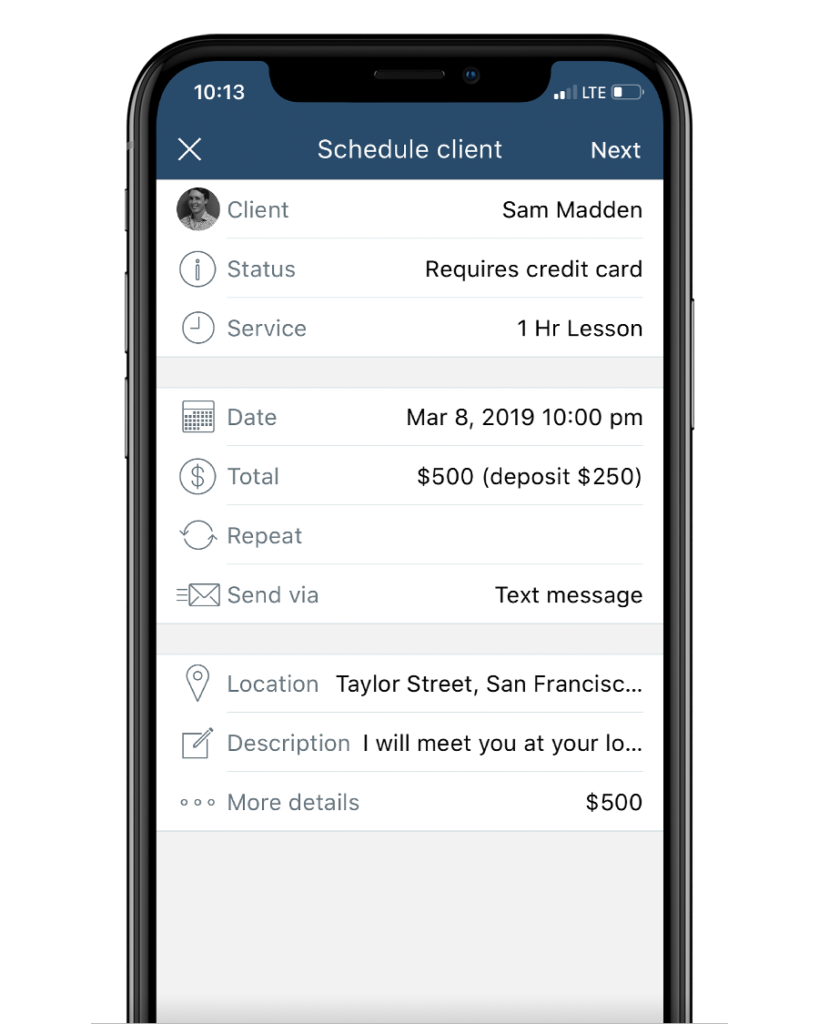

PocketSuite, in characteristic fashion, makes it uber-simple to accept deposits.

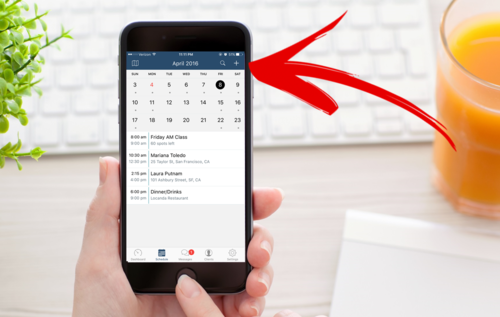

Let’s say you want to book a client on your calendar, but you’d like to require a deposit up-front in order to book the appointment.

That’s a breeze to set up!

Simply hit the plus (+) symbol from your Schedule tab.

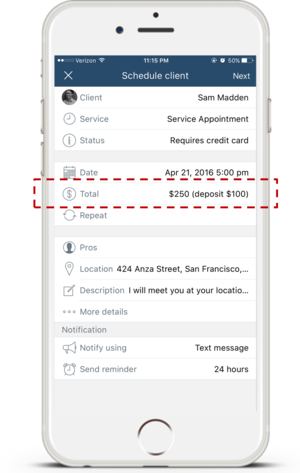

Then make sure the deposit amount is entered. You can enter a partial amount or even the full amount of your service price.

Then hit send!

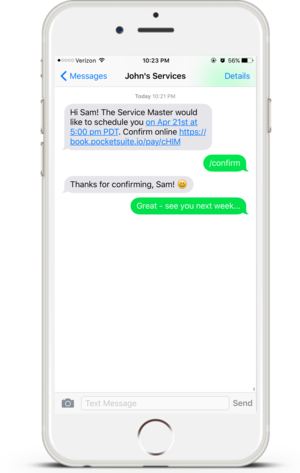

Your client instantly receives a text message with an appointment link.

They tap the link to open up a PocketSuite online form where they can enter their credit card details in order to charge the deposit amount.

The coolest part is – if the client is already in the system, they can just text back the number 1 to confirm and the system will automatically confirm the appointment (since your client’s credit card details are already in your PocketSuite system)!

Within 15 minutes, you’ll have the funds instantly deposited into your bank account.

How easy was that?

Take the pain and frustration out of accepting cash deposits, dealing with no-shows and late cancellations, and massive changes in your income.

Start accepting deposits today with PocketSuite – your clients and business will thank you.

You can even try the PocketSuite free trial to get started accepting deposits today. No strings attached!

Like this article? You’ll love these articles:

- PocketSuite Deposits

- Our guide on how to generate leads for service businesses in 2022

Our Frustrations with Square article