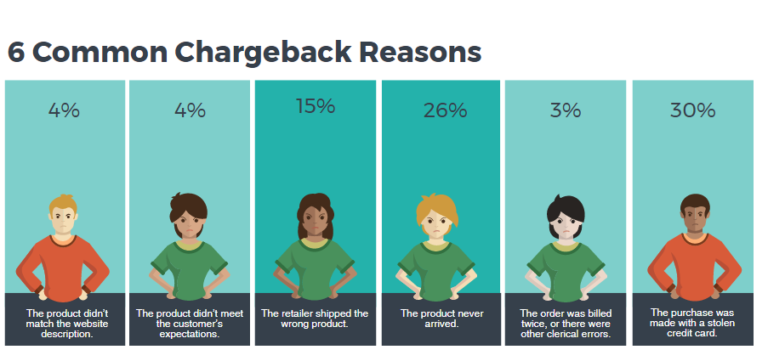

Chargeback disputes are frustrating to deal with. They’re often unfair, illegitimate, and place the burden of proving innocence on the business owner. However, every small business ill at some point need to deal with this nuisance, so let’s discuss the best way of handling a client chargeback. First of all, if you’re not taking payments online, you should be. Only 15% of consumers prefer to pay in cash – a whopping 80% prefer using debit and credit cards.

However, with accepting credit cards comes the risk of chargebacks. This occurs when one of your customers decides to dispute the transaction either because they didn’t like the service your business provided or because they’re attempting to defraud your business.

In either case, there’s a proven strategies for fighting these disputes and in this article we will be covering the basics of how to put your best foot forward while increasing your chances of winning disputes and coming out ahead.

So what are the most common reasons for chargeback disputes?

WHY DISPUTES ARE A PROBLEM

If a merchant regularly has client disputes, your payment processor may impose a monitoring program to keep an eye on you. If this trend continues, your processor may end their relationship with you.

You may even be added to the MATCH list (a blacklist that will restrict you from being able to accept credit cards) if your rate of chargebacks exceeds 1.5% of your total payments.

If you are an online merchant, a good idea is to highlight information on your website about how you handle customer service complaints, refunds, and cancellations.

You may also want to give clients a way to contact you for support and share information on how you respond to unhappy customers on your site. This type of transparency helps prevent confusion from clients who may feel like they didn’t get what they paid for. If they have that feeling and it isn’t addressed, they file a dispute to get back at you or your small business.

A STEP BY STEP GUIDE TO WINNING CHARGEBACK DISPUTES

First, let’s go over the basic steps that take place when a chargeback occurs.

- Your client submits a chargeback dispute with their bank.

- If their bank accepts the dispute, they issue a provisional refund to the client.

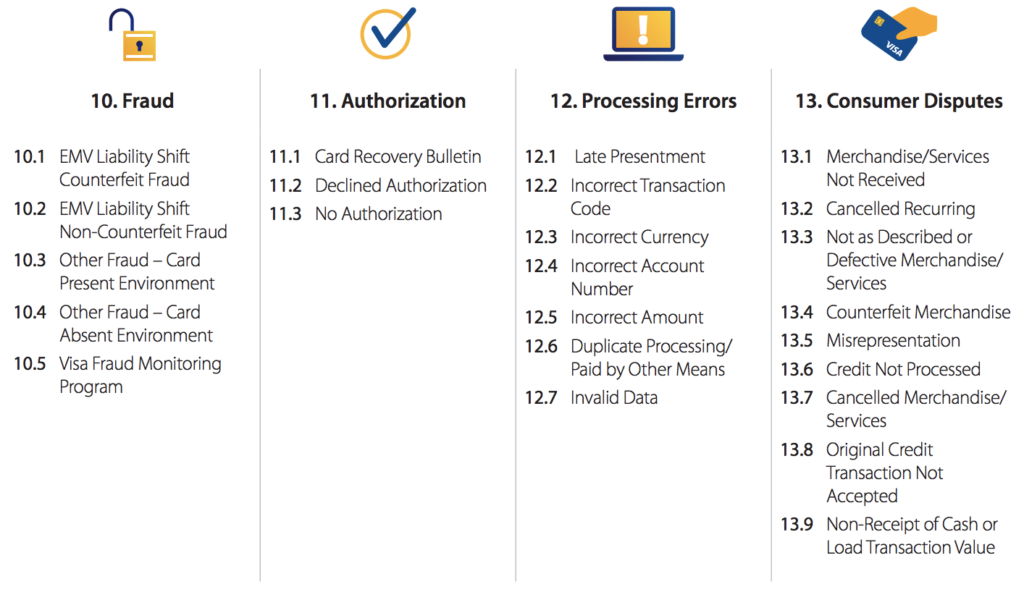

- Their bank contacts your payment processor and gives them a code, which explains why the chargeback was filed (usually the terms to describe the types of chargebacks are: credit not processed, duplicate, fraudulent, general, product not received, product unacceptable, subscription canceled, unrecognized).

- Your payment processor lets you know about the chargeback.

- You choose whether to accept or fight it.

- If you choose to fight it, you need to submit information to your payment processor (usually proof that the charge was authorized).

- Your payment processor reviews the information that you’ve submitted – if they believe it’s sufficient, they submit this information to your client’s bank for review and a decision.

- Your client’s bank reviews the information that you’ve submitted – if they believe that the charge was indeed authorized and your client’s claim isn’t valid, they decide in your favor and your payment processor returns the funds to you. Your client’s bank takes up to 90 days to decide on a dispute. Once the decision is made, your processor immediately returns the funds to you.

- If you do not receive a favorable decision and you do not believe the ruling was fair, (you or the client) can request a second arbitration to decide if your client’s bank’s decision will be upheld.

If you’re still with me, you’ve learned that a critical step in you winning chargebacks is the evidence you submit to your bank to prove the transaction was indeed authorized.

Here are some great examples of evidence you can submit – try to collect as many of these items as possible and send them to your bank:

- Sales receipts

- Order forms

- Tracking numbers

- Transcripts of email communication between you and your customer

- Delivery confirmation

- Records of previous transactions that were not disputed

Here are some more examples of evidence that we’ve seen our customers utilize to win disputes here at PocketSuite:

- Phone transcripts of conversations you’ve had with your client

- Photos / videos of the completed job or service (if you’re in the service industry)

- IP address of the client matching their location to the service address

- Match the address on the credit card to the service address

- Signed proof of delivery (if you sold a product)

- The terms and conditions that the customer agreed to at the time of purchase

- Messaging history between you and your client

- Signed contract by your client

- Completed intake forms

- Appointment confirmations

- Gratuity/tip payment receipts to prove client was happy with service

Here are some more tips to prevent chargeback disputes from occurring in the first place:

- Check the client’s name and address on their ID – make sure it matches the name on the credit card. If it doesn’t match, get authorization in an email or text message from the credit card owner.

- Have your terms and conditions visibly displayed on your website, including on your booking form

- MyMoid recommends using customer service to resolve the dispute

- Make sure you fight the disputes – otherwise you’ll damage your reputation with payment processors

Here is a graphic that displays a more detailed list of dispute reasons with associated codes which was referenced at a high level above – make sure you are familiar with these codes when you’re submitting your evidence. Your response should be targeted to disprove the specific reason given:

Note that if you’re using Venmo for your business, you’re not allowed to fight chargeback disputes.

Similarly, if you’re using Square, their dispute resolution library is really confusing, difficult to navigate, and almost impossible to take action on.

Instead of using a standalone payment processor, why not use one that comes with integrated business tools like booking, contracts, forms, notes, and more? You get invaluable data (such as client, transaction, and sales data) which makes it so much easier for you to protect yourself from disputes, in the first place and effectively fight them when they do arise.

Imagine if a credit card company gave you insurance – that’s what it’s like using PocketSuite to process your payments and protect your from chargeback disputes.

If you’re going to be processing credit cards, you need a payment processor that has your back.

In fact, we’ve heard of customers leaving Square because they didn’t hear back from them when trying to resolve a dispute.

One client mentioned “There was no notification from Square, the money was just taken out of my account… I didn’t hear back from them, and by then the fraudsters were long gone…”

Another former Square client explains:

“I had an extra fee dispute fee, and I didn’t hear back about anything happening with the process. I submitted information and didn’t hear back if it was considered – I had to wait 90 days before I heard anything. The money was held up for that amount of time – then I lost the dispute and I didn’t even get an explanation for why.”

PocketSuite helps you collect additional proof that your terms of service were agreed to and your payments were authorized, which can expedite your client’s bank’s decision.

We will give you a heads up before the official dispute is filed as we get advanced notification from our technology platform partner, Stripe.

This gives you an additional window of time before the dispute is official to contact the client and resolve the issue, even if you need to split the difference with them.

This way a chargeback dispute doesn’t give you a bad mark and the entire payment isn’t clawed back by your client’s bank. As they say in healthcare, prevention is better than cure.

So go with a payment processor that helps you prevent disputes before they even occur.

This way you can rest easy knowing you’re taking all of the necessary steps to prevent disputes before they happen and are armed with all of the tools to help win disputes that you will inevitably get (hopefully, very infrequently) on your journey to achieving your business and income goals.

Winning disputes doesn’t have to be hard – you just need a payment processor that has your back.

Speaking of payment processors, why not give PocketSuite a shot? We have a free trial to get you started accepting credit cards ASAP.

Like this article? You’ll love our guide on how to generate leads for service businesses in 2024, and of course our Frustrations with Square article!