POS & Payments

Accept Payments Fast From Anywhere

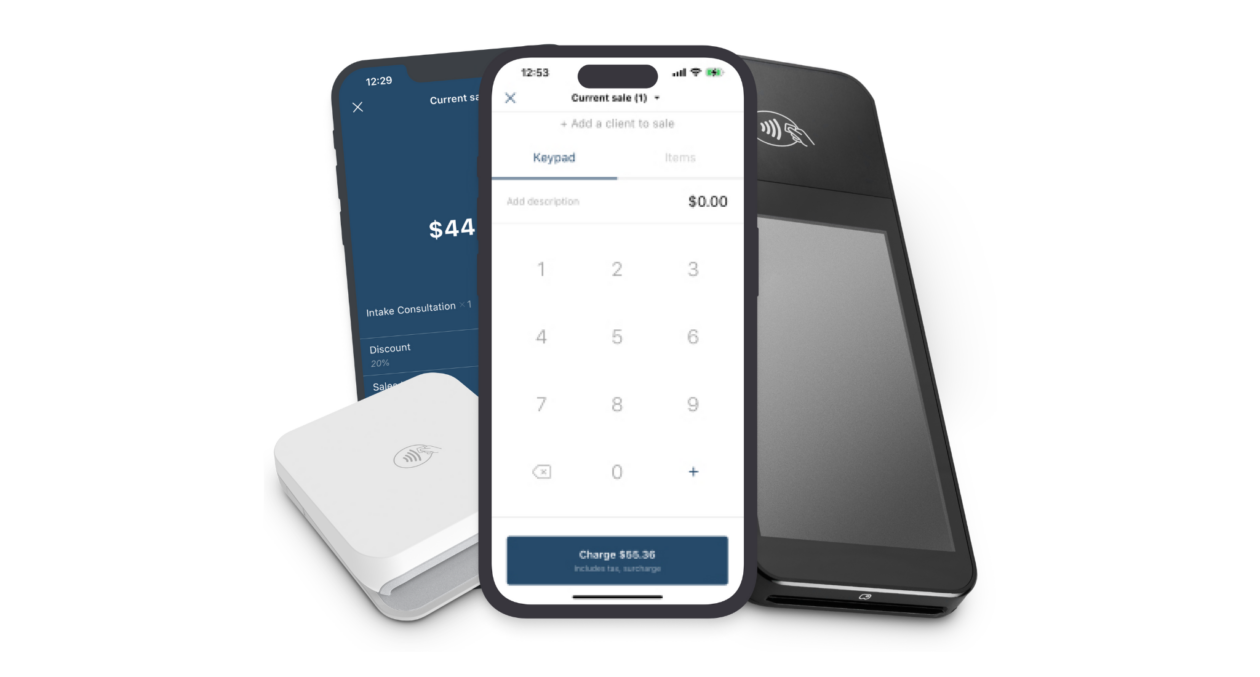

Charge clients for any service or product at any time with a card swipe or by inserting the chip into a POS card reader. If you don’t want any hardware, you can just scan the client credit card or type the card number directly into the app from your phone.

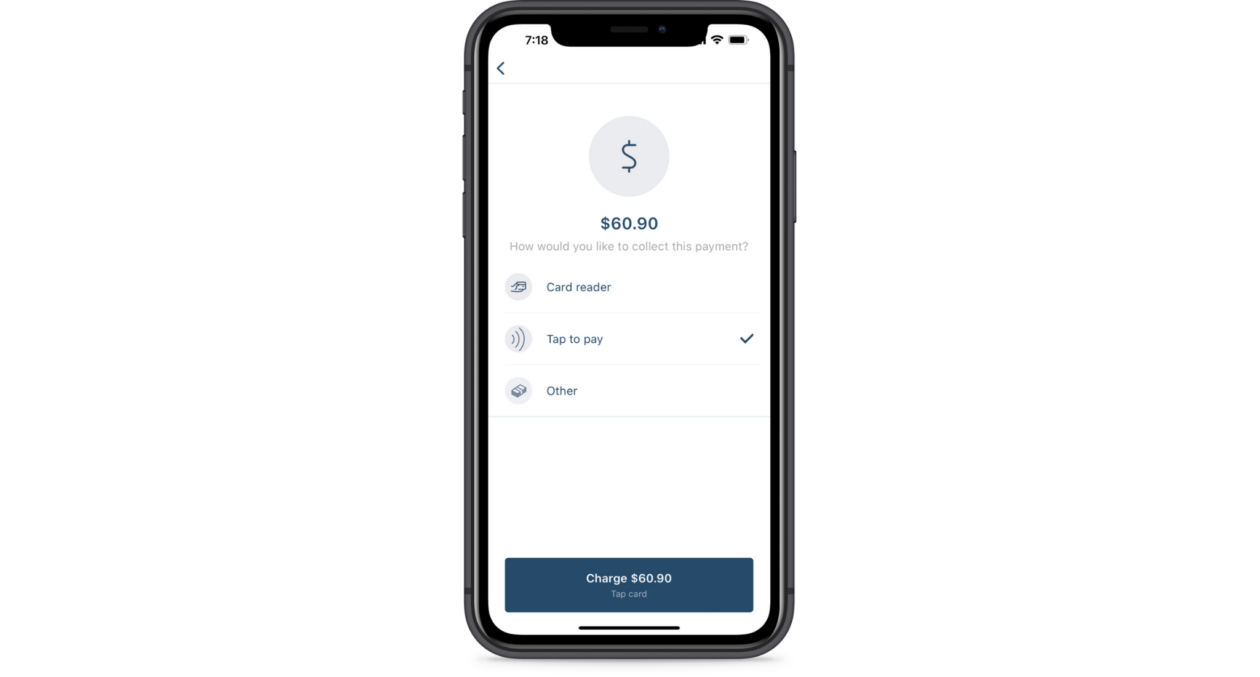

Accept Contactless Payments with Tap to Pay

Accept in-person contactless payments with eligible physical credit and debit cards as well as with digital wallets such as Apple Pay.

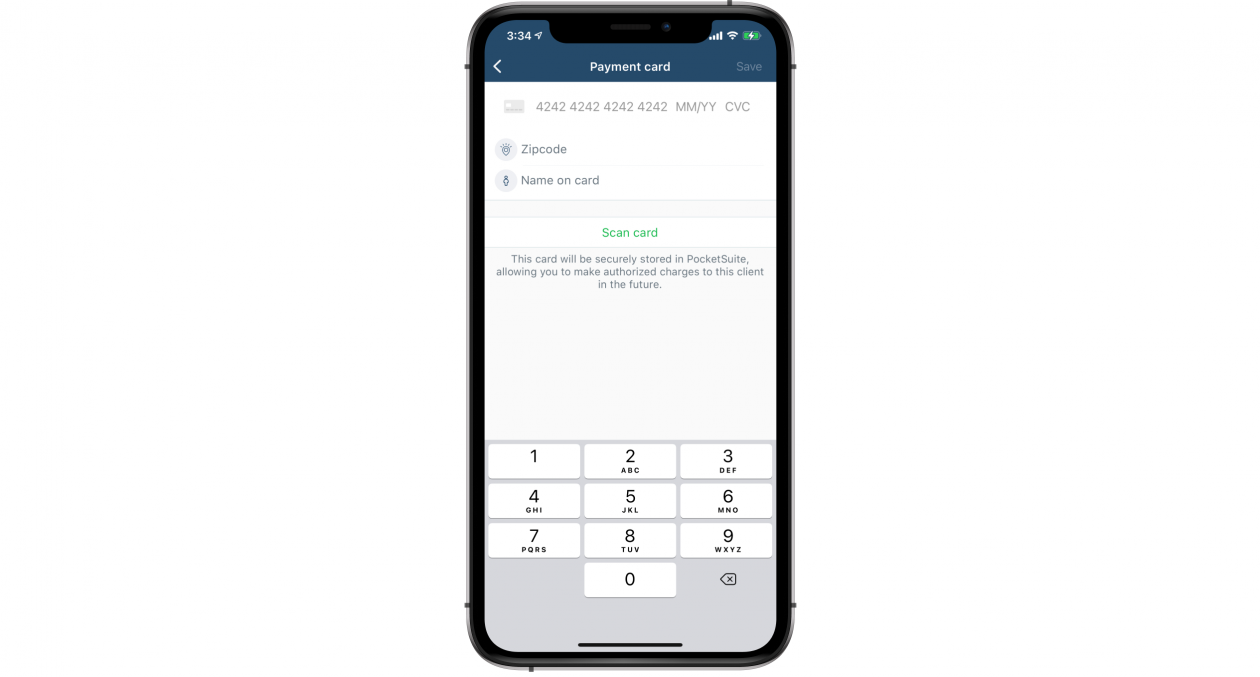

Use your Camera to Scan Cards

Simply charge clients cards with or without a card reader right away with your PocketSuite account by using your phone’s camera to scan the card, or entering in the information manually.

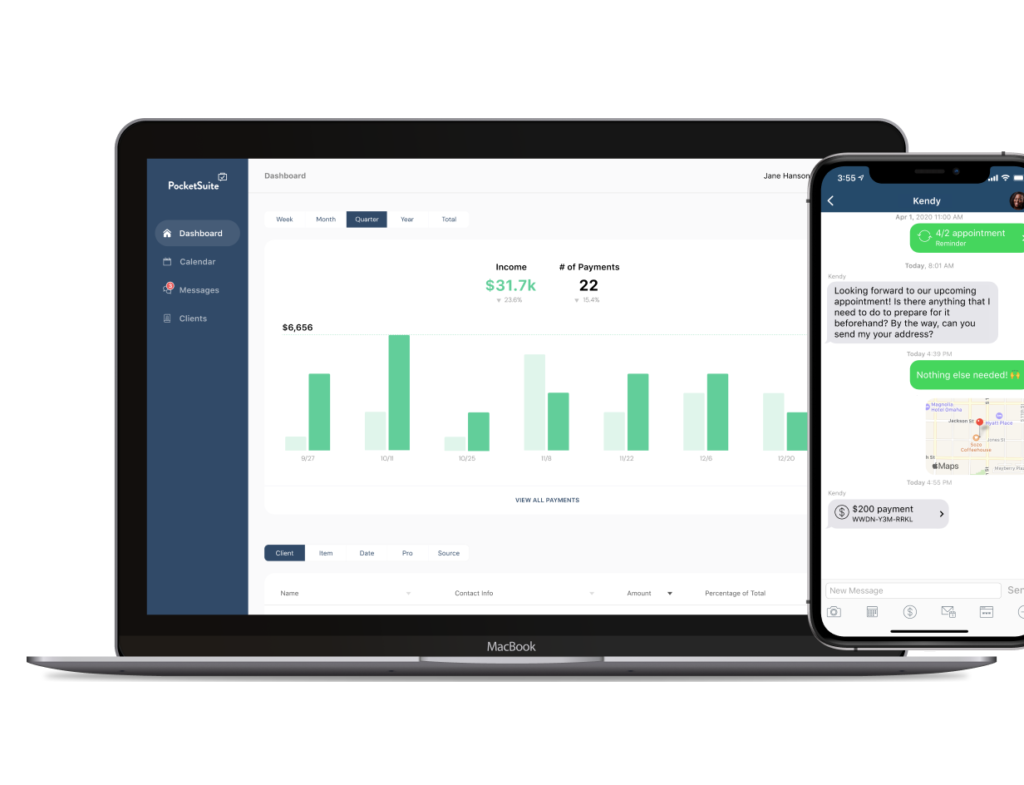

POS is Available on Desktop / Tablet

Plus, you can use as a terminal / front desk!

Download the app

FAQ

When will I receive my money?

All payments are deposited into your bank account within 24 hours. If you use our Instant Payouts feature, you will receive your funds within 15 minutes.

Note: If your client pays by ACH bank transfer, instead of a debit or credit card, note that the funds take 5-7 days to clear before being processed for a payout.

Learn more about Instant Payouts here!

How can I see how much I will receive on my next payout?

- You can go to your pending payments dashboard to see the next payout and which client payments are included, or the Payments export type will include spreadsheets for payments as well as deposits. Go to settings > data export to send the email.

- Payments go to your bank account on file every day at noon PT and it takes your bank 1-2 business days to make it available to you. However, if you’d like your payment more quickly, we offer Instant Payouts for an extra 1% processing fee.

Are there any monthly fees or limits?

Absolutely not. You’re welcome to charge as much as you’d like whenever you like. We understand that your payment activity may change from month to month, which is why we do not charge monthly minimums.

What are your processing fees?

The credit card processing fee for PocketSuite is 2.9% + $0.30, no matter what type of card your client uses. It is one of the lowest in the industry and there are no hidden fees.

Do you have a card reader?

Yes, PocketSuite currently offers two PCI-compliant card readers that are pre-certified with Stripe – a mobile M2 reader for iOS and Android devices, and a hybrid countertop/handheld BBPOS Wise POS E reader for desktop and mobile devices. Interested in a card reader? Order directly thru the app by going to Settings > Card Readers and place your order.

Do I need the card reader?

No, you do not. You can use the in app card scanner with your built-in, mobile phone camera or simply enter the card details manually.

Is the app only for US customers?

PocketSuite currently only supports businesses within the US. However, your clients can pay you from anywhere as long as their credit cards have the Visa, Mastercard, AMEX or Discover card logos. We also accept Apple Pay.

Is PocketSuite PCI compliant?

Not only do we not store any payment information, our card readers can’t be read or decrypted by us or anyone else.

What’s the best way to deal with an unhappy client and prevent a chargeback?

- See reasons why a client might dispute a payment.

- PocketSuite helps you manage client expectations when it comes to clearly communicating key information to your clients, like cancellation policies or renewal dates. Making sure your clients, both first timers and loyal clients understand what to expect can help prevent unexpected, unhappy moments for clients.

- PocketSuite helps you directly communicate with clients through Messaging to maintain and nurture your client relationships.

- See how to protect yourself and your business from disputes.

- See also how to refund a client’s payment.

- See also what to expect if there is a dispute.

How will I be able to collect the balance due after the appointment?

- First, see 10 ways to accept payment on PocketSuite.

- Next, see Invoicing for details on sending invoices to clients to pay.

- Then, check out Online Payments. Outside of the invoicing system, you can also request a specific amount for your clients to pay via PocketSuite.

- You could also consider placing the Payments Widget on your website.

- See also Receiving Payments in PocketSuite for timing of payouts to your bank account.

- See also Payment Plans for clients via PocketSuite.

Can I collect upfront payments when clients book?

- Yes! Simply hit the plus (+) symbol from your Schedule tab.

- Then make sure the deposit amount is entered. You can enter a partial amount or even the full amount of your service price.

Is the reader available on desktop / tablet?

The reader is available on desktop /tablet and you can use the desktop as a terminal / front desk. BBPOS WisePOS E price for the terminal in our Stripe dashboard is $249 plus S&H ($8 for regular shipping) and taxes (depending on state). You should buy the BBPOS WisePOS E reader unit to use on Desktop. With the card reader feature enabled, head to Settings > Card reader to purchase a card reader.