Offer interest-free financing with Buy Now Pay Later

Boost sales with Buy Now Pay Later!

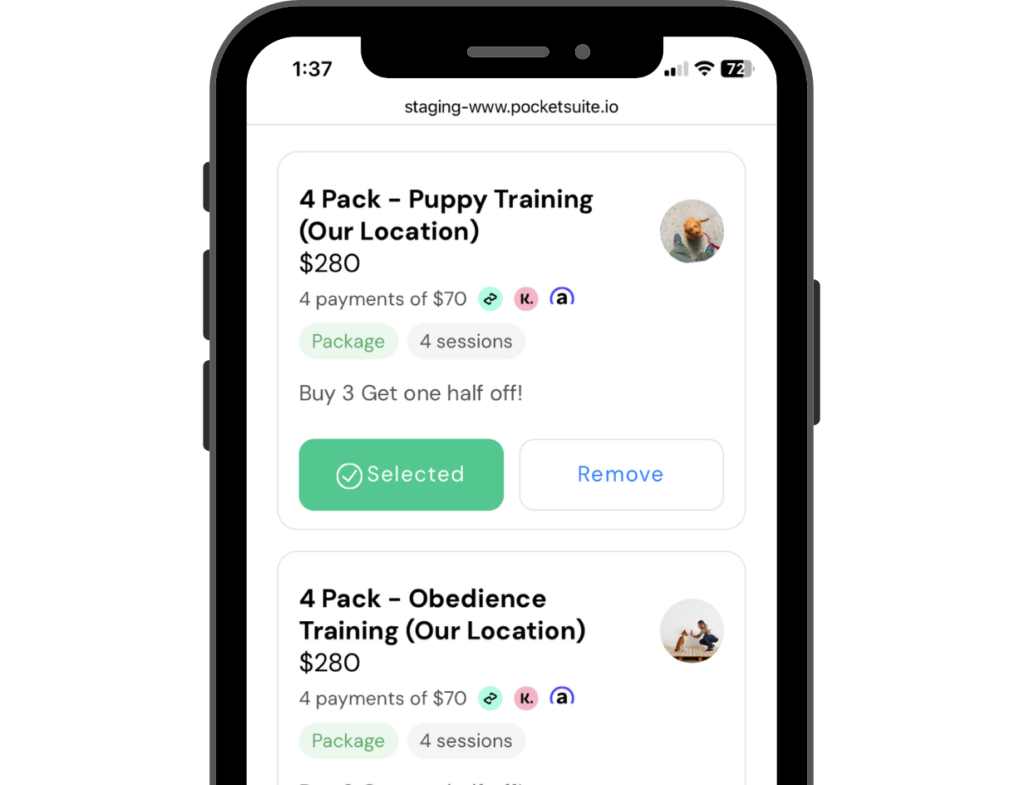

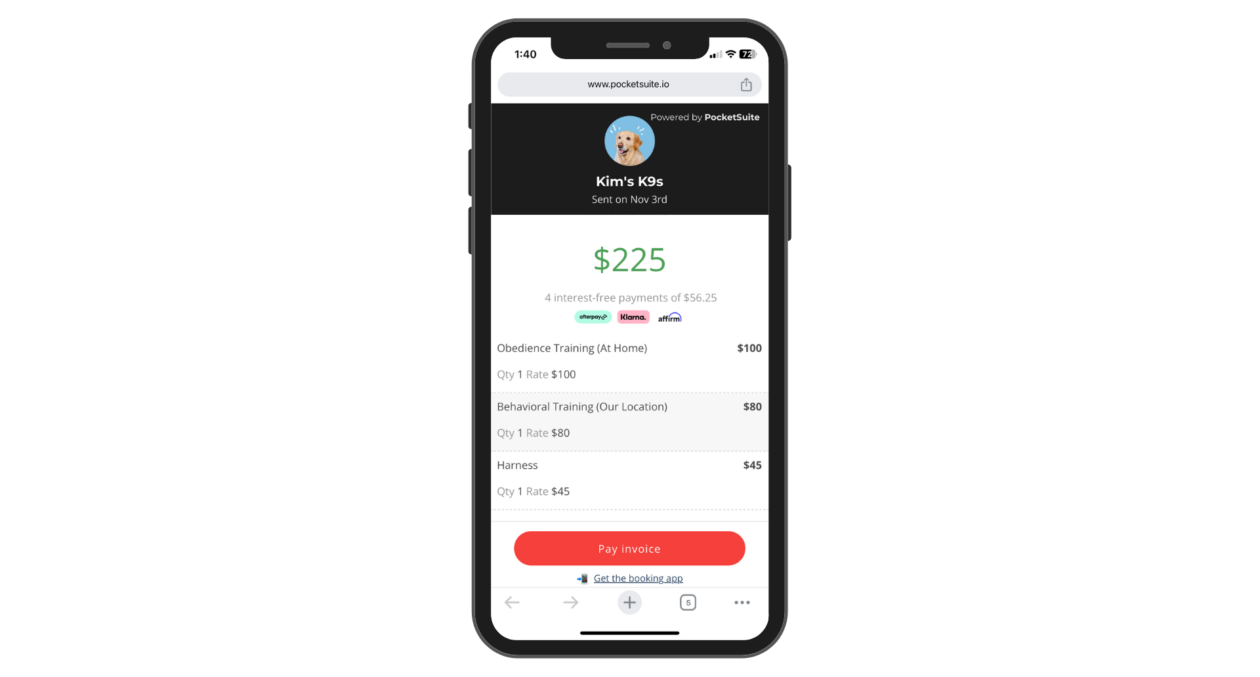

Allow clients to pay in installments at checkout

Clients can pay for packages, invoices, and product orders with BNPL financing.

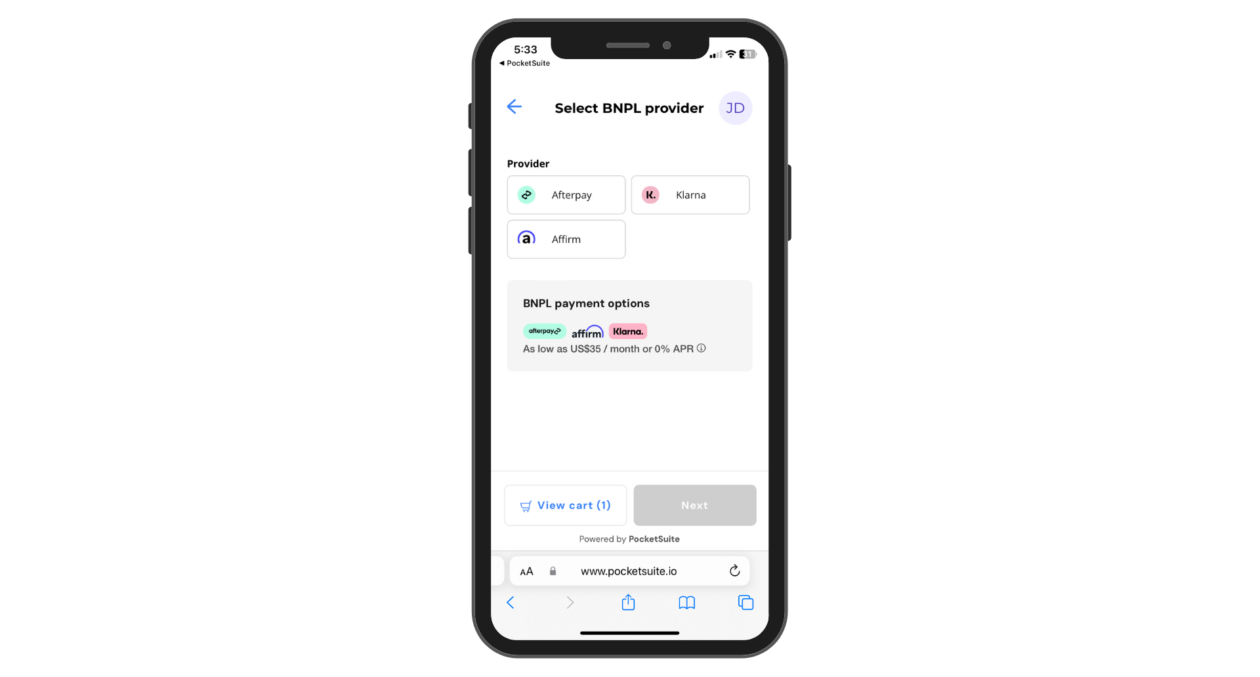

Pick a preferred provider

If approved, clients can finance their purchases using trusted BNPL providers: Affirm, Klarna, or AfterPay

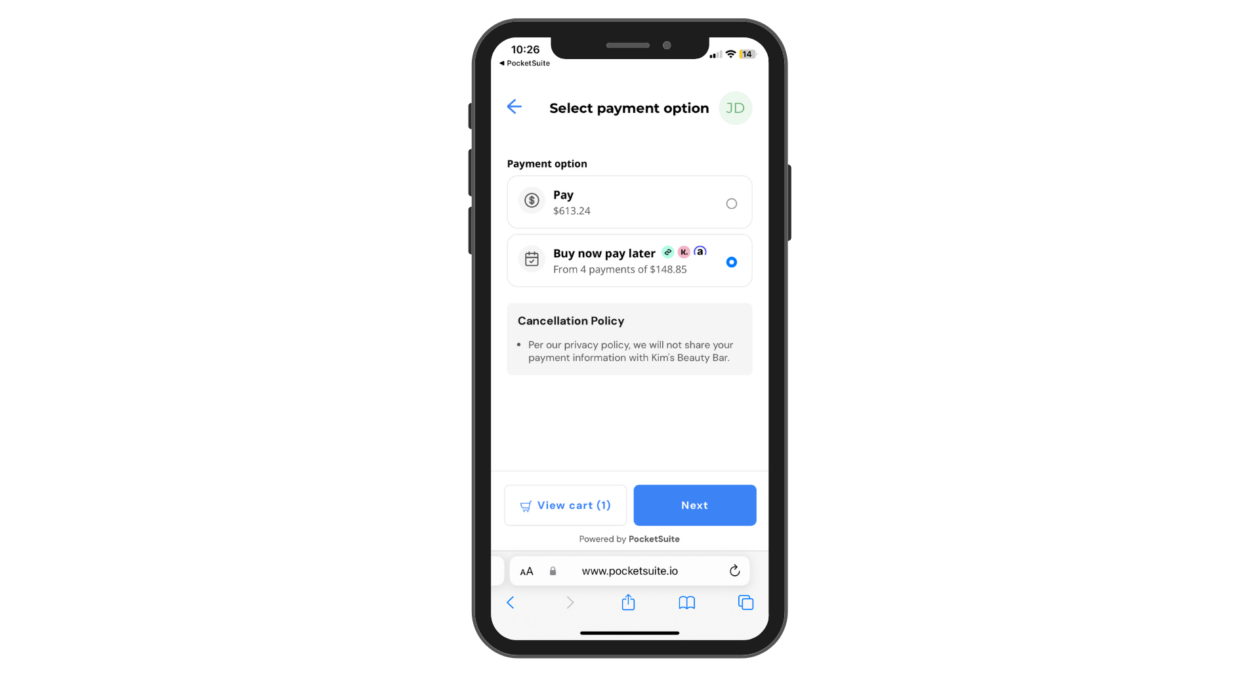

Give clients more ways to pay

Send clients a payment widget via email, or ask them to download the client app, to pay their balance on packages, invoices, or product orders.

F.A.Q.s

What is Buy Now Pay Later?

Buy Now Pay Later allows clients to finance their purchases using an approved provider, like Affirm, Klarna, or AfterPay. You (as the business owner) will receive the full amount upfront, while your client will pay back the provider in installments.

How does Buy Now Pay Later work?

With Buy Now Pay Later, your clients can finance their purchases using Affirm, Klarna, or AfterPay. Once Buy Now Pay Later is turned on, it will be available for all package and invoice payments as well as online product orders.

If a client chooses to finance their purchase with BNPL, they’ll be automatically taken to the provider’s website during checkout to get approved. Think of it as a credit card or low-interest loan. You (as the Pro) get paid the full amount upfront. It is your client’s responsibility to repay their chosen BNPL Provider.

Read our full guide to Buy Now Pay Later.

Can clients leave a tip if they select Buy Now Pay Later as their payment option?

Yes! Gratuity can be selected before the client is prompted to select a payment option. Gratuity will be included in the Buy Now Pay Later financed amount. Make sure you have Gratuity set up in Settings>Gratuity.

What is the Buy Now Pay Later fee? Will it take longer for me to receive payouts when clients finance their purchases with Buy Now Pay Later?

Purchases financed with Buy Now Pay Later come with a flat 6% + $0.30 rate for payment processing, which includes PocketSuite’s standing processing fee. BNPL payments from your client are paid out to you in the same time frame as standard client credit/debit card payment transactions. You can receive funds in your bank account in 1-2 business days.

If my client defaults on their Buy Now Pay Later (BNPL) financing, am I or my business liable to repay it?

Once your client is approved for Buy Now Pay Later, it works just like a credit card or a 0% / low-interest loan. Your client (not you) is completely responsible for repayment to the Buy Now Pay Later financing provider.